Dividend Yield of Air Products & Chemicals

In this series, we’ll be looking at ten dividend aristocrats with low PE ratios. Dividend aristocrats are S&P 500 stocks that have raised their dividend payouts for at least 25 successive years.

Aug. 23 2017, Published 12:42 p.m. ET

Air Products & Chemicals: Basic materials sector, chemicals major diversified industry

In this series, we’ll be looking at ten dividend aristocrats with low PE (price-to-earnings) ratios. Dividend aristocrats are S&P 500 stocks that have raised their dividend payouts for at least 25 successive years. The S&P 500 (SPY) (SPX-INDEX) offers a dividend yield of 2.4% at a PE ratio of 21.5x.

Air Products & Chemicals (APD) sells gases and chemicals for industrial consumption. Sales fell in fiscal 2015 and fiscal 2016, driven by a weaker energy cost pass-through to customers and currency fluctuations. Sales of industrial gases in the Americas, the EMEA (Europe, the Middle East, and Africa), and materials technologies fell, partially offset by sales for Asia and the global segments on a YoY (year-over-year) basis. EPS (earnings per share) for fiscal 2016 took a beating despite growth in operating income. EPS was hampered by the loss from discontinued operations.

Sales for the first nine months of 2017 recorded impressive growth, driven by an energy cost pass-through to customers. Every segment except the EMEA recorded growth on a YoY basis. Operating income fell, driven by higher operating costs and impairment expenses. EPS obviously got a big boost from higher sales in the Performance Materials division. Strong 3Q17 EPS growth led to an increase in the company’s earnings guidance for fiscal 2017.

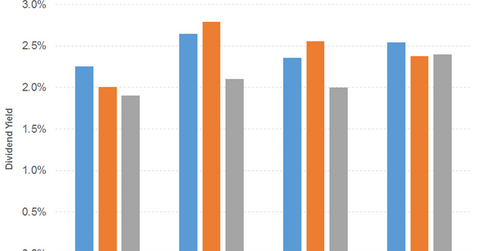

In the graph below, you can see Air Products & Chemicals’ dividend yield compared to the S&P 500 and Praxair (PX). (The asterisk in the graph denotes an approximation in calculating dividend yield.)

This year represents the company’s 35th successive year of dividend growth. The company has also succeeded in growing its free cash flow in the last three years. It has not initiated any share buybacks in the last three years. While its dividend yield has fallen over the years, it’s still at par with the S&P 500.

PE ratio

APD’s PE ratio of 21.0x is pitted against a sector average of 88.7x. The dividend yield of 2.6% is pitted against a sector average of 2.4%. In the graph below, we see Air Products & Chemicals’ price movement compared to the S&P 500 and Praxair. An increase in dividend yield is often associated with a fall in price, which is not an ideal scenario for investors.

While the company continues to remain focused on new industrial gas plant investments and cost cuts, the separation from its Electronics Materials division and the sale of its Performance Materials division are expected to affect its fiscal 2017 earnings. Adding to further miseries is the slowdown in LNG (liquefied natural gas) equipment demand triggered by weak oil and gas prices.

Air Products & Chemicals has its platter full, ranging from industrial gas projects in Louisiana, New York, and China and onstream air separation unit projects in India and China.

The Vanguard High Dividend Yield ETF (VYM) offers a dividend yield of 3.0% at a PE ratio of 21.6x. It’s a diversified ETF. The iShares International Select Dividend (IDV) offers a dividend yield of 4.2% at a PE ratio of 13.5x. It’s a geographically diversified ETF with substantial exposure in financials and Europe.