Did Vornado’s Cost Reduction Efforts Bear Fruit in 2Q17?

Vornado Realty Trust reported adjusted FFO (funds from operation) of $1.35 per share, which beat Wall Street estimates of $1.20 per share.

Aug. 4 2017, Updated 10:36 a.m. ET

2Q17 income

Vornado Realty Trust reported adjusted FFO (funds from operation) of $1.35 per share, which beat Wall Street estimates of $1.20 per share, an 11.5% increase from 2Q16. High demand for the company’s assets combined with prudent cost control have led to the upbeat profits during the quarter.

Same-store NOI by segment

Same-store NOI (net operating income) rose 10.6% in New York compared to the year-ago level. NOI, however, rose 4.5% sequentially. The sequential figure consisted of a non-same-store increase of 7 million and EBITDA (earnings before interest, taxes, depreciation, and amortization) from the property located at 85 Tenth Avenue. Income was partially offset by dilution due to the disposition of properties.

In Washington DC, same-store NOI rose 0.5% year-over-year and 2.5% sequentially. The 555 California Street segment reported a 33.7% gain in same-store NOI compared to a year ago. However, same-store NOI fell 1% sequentially. The company’s theMART segment reported a same-store NOI decline of 2.8% year-over-year and a 2.3% sequential rise.

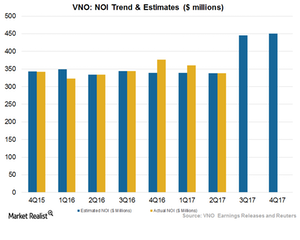

Analysts expect NOI to remain flat at $312.7 million, as higher revenue is expected to be offset by the dilution in earnings due to VNO’s recent property spin-offs.

Vornado and peers like AvalonBay Communities (AVB), Boston Properties (BXP), and Equity Residential (EQR) may face higher expenses in the future due to the high-interest rate environment.

The iShares Cohen & Steers REIT ETF (ICF) invests 12.4% of its portfolio in Vornado and its REIT peers. ICF is worth a look, as its wide product diversity buffers against interest rate hikes.