Chemours Stock Fell despite Strong Earnings in 2Q17

Chemours (CC) reported its 2Q17 earnings on August 2, 2017, after the markets closed. The company’s management held a conference call on August 3, 2017.

Aug. 7 2017, Published 11:33 a.m. ET

Chemours’ 2Q17 earnings

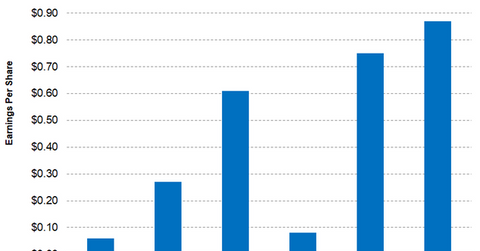

Chemours (CC) reported its 2Q17 earnings on August 2, 2017, after the markets closed. The company’s management held a conference call on August 3, 2017, to discuss the earnings results. Chemours reported an adjusted EPS (earnings per share) of $0.87—an increase of 222.20% on a YoY (year-over-year) basis. In 2Q16, the company reported an adjusted EPS of $0.27. It also beat analysts’ estimate of $0.85 per share.

The increase in Chemours’ adjusted EPS was driven by higher volumes across its reporting segments. Its COGS (cost of goods sold) and SG&A (selling, general and administrative) expenses as a percentage of sales fell. Chemours reported COGS of $1.15 billion, which represented 72.20% of the sales. In 2Q16, Chemours’ COGS was $1.12 billion, which represented 80.70% of the sales. It fell by 850 basis points on a YoY basis.

Similarly, Chemours’ SG&A expenses for 3Q17 were $157 million, which represented 9.90% of the sales. In 3Q16, its SG&A expenses were $174 million, which represented 12.60% of the sales. It fell by 270 basis points on a YoY basis.

Stock price and guidance

Since its earnings were announced after the market hours on August 2, 2017, Chemours stock fell 1.70% the next day. On the same day, its peers Kronos Worldwide (KRO) and Tronox (TROX) fell 2% and 0.36%, respectively.

Now, Chemours expects to post adjusted EBITDA (earnings before, interest, tax, depreciation, and amortization) to be $1.3 billion–$1.4 billion in fiscal 2017—compared to its earlier guidance of $1.15 billion–$1.25 billion.

Investors can indirectly hold Chemours by investing in the PowerShares DWA Basic Materials Momentum Portfolio (PYZ). PYZ has invested 4.90% of its holding in Chemours. The fund also provides exposure to FMC (FMC) with a weight of 4.30% as of August 3, 2017.

In this series, we’ll discuss Chemours’ earnings, revenue, and analysts’ latest recommendations after 2Q17.