AvalonBay Revenue Climbs in 2Q17, Backed by Rent Growth

Robust 2Q17 driven by rent growth AvalonBay Communities’ (AVB) total revenue of $530.5 million marginally surpassed Wall Street estimates by 0.3%. However, revenue rose by almost 6% from the year prior. Upbeat top-line growth reflected growth in development communities and stabilized operating communities. Same-store revenue rose 2.5% year-over-year. Including revenue from redeveloped communities, same-store revenue […]

Aug. 9 2017, Updated 9:08 a.m. ET

Robust 2Q17 driven by rent growth

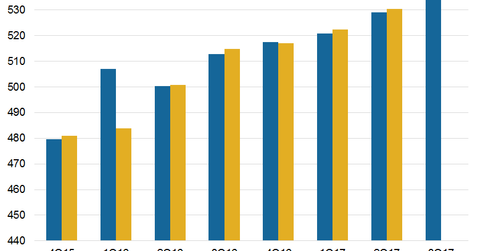

AvalonBay Communities’ (AVB) total revenue of $530.5 million marginally surpassed Wall Street estimates by 0.3%. However, revenue rose by almost 6% from the year prior. Upbeat top-line growth reflected growth in development communities and stabilized operating communities. Same-store revenue rose 2.5% year-over-year. Including revenue from redeveloped communities, same-store revenue climbed 2.6%.

As there is a secular shift of US demographics towards affluent Class A cities with high-income growth and demand, residential REITs such as UDR (UDR), Essex Property Trust (ESS), and Equity Residential (EQR) are repositioning their properties towards these cities, which typically have high barriers to entry and excellent infrastructure.

The SPDR Dow Jones REIT ETF (RWR), of which the aforementioned stocks form 13%, has a year-to-date return of 2%. AvalonBay maintains a modest rent growth trend. Its strategic location in the six coastal markets of New England, the New York metropolitan area, the Mid-Atlantic, the Pacific Northwest, Northern California, and Southern California is a winning strategy. Furthermore, AvalonBay undertakes several development activities.

Established communities drove rent growth in 2Q17

The company’s established communities reported a 2.5% gain in average rental rates. Occupancy remained flat and stood at 95.4%. Total revenue for these communities rose 2.5% to $394.3 million. Including current and previously completed redevelopment communities, average rental revenue rose 2.6%.