Why Were Asian Markets Mixed on August 28?

On August 28, the Shanghai Composite opened the day above the important resistance of 3,300 and rose to fresh 20-month high price levels.

Aug. 28 2017, Published 8:58 a.m. ET

Economic calendar

8:30 AM EST – US goods trade balance (July)

7:30 PM EST – Japan’s household spending (July)

7:30 PM EST – Japan’s jobs-to-applications ratio (July)

7:30 PM EST – Japan’s unemployment rate (July)

China

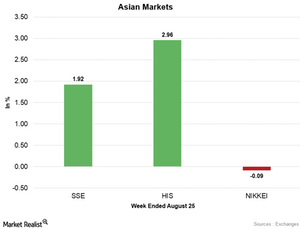

After rising for two consecutive trading weeks, China’s Shanghai Composite Index started this week on a stronger note. Despite a lack of major economic releases last week, the Shanghai Composite Index moved higher amid the strong market sentiment and rally in major sectors.

On August 28, the Shanghai Composite opened the day above the important resistance of 3,300 and rose to fresh 20-month high price levels. The rally in financials helped the market trend higher on Monday. Also, stronger-than-expected earnings by industrial sector stocks added upward momentum. The market sentiment improved due to steps being taken by China’s government to allow more public and private investments to restore state-owned enterprises. Technical buying, triggered as the market breached the important resistance level of 3,300, also pushed the Shanghai Composite Index higher.

On August 28, 2017, the Shanghai Composite Index rose 0.93% and ended at 3,362.65. The SPDR S&P China ETF (GXC) rose 0.47% and closed at 100.19. China’s markets are looking forward to the release of manufacturing and non-manufacturing PMI data that are scheduled to release on August 30.

Hong Kong

After regaining strength last week, Hong Kong’s Hang Seng Index started this week on a stable note. Stronger-than-expected earnings released by Hong Kong’s companies pushed the market higher on Monday. The rally in China’s banks and insurers in Hong Kong markets also extended support to the market on Monday. Fed Chair Janet Yellen’s expectation of no more interest rate hikes in 2017 also added strength to the market. On August 28, the Hang Seng Index rose 0.1% and closed the day at 27,875.50. In the morning session, the Hang Seng Index breached the important resistance of 28,000—the highest close since 2015. On Friday, the iShares MSCI Hong Kong Index (EWH) rose 0.66% and closed at 24.46.

Japan

After falling for six consecutive trading weeks, Japan’s Nikkei Index started this week on a mixed note. It opened higher amid a rally in Asian markets but pulled back as the day progressed and ended flat. The yen gained strength against the dollar after the Jackson Hole symposium and weighed on the Nikkei Index on Monday. The market is looking forward to the release of household spending and unemployment data that are scheduled to release at 7:30 PM EST on Monday. The Nikkei Index closed the day at 19,449.90—a fall of 0.01%. The iShares MSCI Japan Index (EWJ) rose 0.33% to 54.36 on August 25.

In the next part of this series, we’ll see how European markets performed in the morning session on August 28, 2017.