Asian Markets Are Mixed amid Improved Market Sentiment

On August 30, 2017, the Shanghai Composite Index fell 0.05% and ended at 3,363.63. The SPDR S&P China ETF (GXC) rose 0.02% and closed at 99.50.

Aug. 30 2017, Published 8:41 a.m. ET

Economic calendar

8:00 AM EST – Germany’s CPI (consumer price index) (August)

8:15 AM EST – US ADP non-farm employment change (August)

8:30 AM EST – US GDP (Q2)

9:15 AM EST – US FOMC member Powell speaks

10:30 AM EST – US crude oil inventories

7:01 PM EST – UK GfK consumer confidence (August)

7:50 PM EST – Japan’s industrial production (July)

9:00 PM EST – China’s manufacturing PMI (purchasing managers’ index) (August)

9:00 PM EST – China’s non-manufacturing PMI (August)

China

After two consecutive weeks with a strong performance, China’s Shanghai Composite Index closed last week above the important resistance level of 3,300. Carrying the strength forward, Chinese markets started this week on a positive note by rising to a fresh 20-month high on Monday.

However, the market lost momentum on Tuesday and remained flat at elevated levels due to a profit triggered by bearish global sentiment amid geopolitical concerns. Despite the improved global sentiment on Wednesday as North Korea concerns subsided, the Chinese market didn’t gain upward momentum due to the stronger yuan. The stronger yuan weighed on the market and resulted in a pullback in the banking sector. However, the stronger yuan supported real estate and airline stocks. The market is looking forward to the release of China’s manufacturing and non-manufacturing PMI data at 9:00 PM EST today.

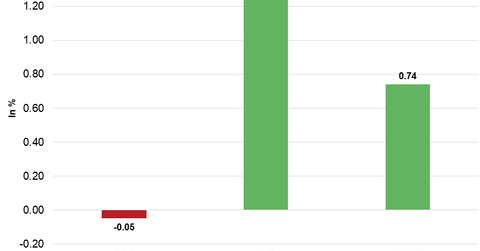

On August 30, 2017, the Shanghai Composite Index fell 0.05% and ended at 3,363.63. The SPDR S&P China ETF (GXC) rose 0.02% and closed at 99.50.

Hong Kong

Hong Kong’s Hang Seng Index regained strength last week amid the market’s improved risk appetite and global sentiment. With support from strong earnings, the Hang Seng Index started this week on a positive note but lost strength on Tuesday amid North Korea’s missile launch. The Hang Seng Index started higher on August 30 and closed the day above 28,000 for the first time since May 2015. Lower North Korea tensions and signs of increased money inflows from China pushed the Hang Seng Index higher. On Wednesday, the Hang Seng Index rose 1.3% and closed the day at 28,126. On August 29, the iShares MSCI Hong Kong Index (EWH) fell 0.08% and closed at 24.40.

Japan

Japan’s Nikkei Index started this week on a weaker note after falling for six consecutive trading weeks. After falling on Tuesday amid the dented global sentiment, the Nikkei Index opened higher on Wednesday and rebounded amid decreased concerns about North Korea’s actions. The market is looking forward to the release of Japan’s industrial production at 7:50 PM EST today.

The Nikkei Index closed the day at 19,506.54—a gain of 0.74%. The iShares MSCI Japan Index (EWJ) fell 0.2% to 54.31 on August 29.

In the next part of this series, we’ll see how European markets performed in the morning session on August 30, 2017.