Why Air Products & Chemicals’ Revenue Rose in 3Q17

Air Products & Chemicals (APD) follows October 1–September 30 as its fiscal year. The company reported revenue of $2.11 billion.

Aug. 4 2017, Updated 12:36 p.m. ET

Revenue in 3Q17

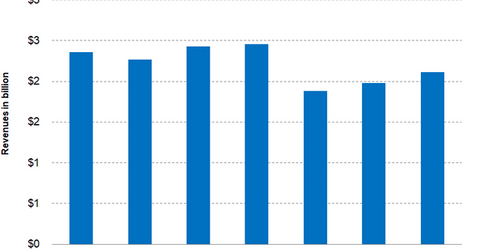

Air Products & Chemicals (APD) follows October 1–September 30 as its fiscal year. The company reported revenue of $2.11 billion, which implies a fall of 13% on a year-over-year basis. However, the fall was primarily due to the spin-off of its Electronic Materials division, now Versum Materials (VSM), and the divestiture of its Performance Materials division. On a continuing business basis, Air Products & Chemicals’ revenue rose 10.50%. Its revenue beat analysts’ estimates of $2.06 billion.

The increased revenue was primarily driven by new business wins in the US, China, and India, which resulted in higher volume growth. Air Products & Chemicals’ volume growth was seen across all of its reporting segments. Price increases for industrial gases in Asia also helped its revenue growth. However, the foreign exchange hedge had a negative impact on Air Products & Chemicals’ revenue. It can have a positive impact in the upcoming quarters as the dollar’s weakness continues.

Management commented on 3Q17 results

Air Products & Chemicals’ chairman, president, and CEO, Seifi Ghasemi, said, “Once again, the committed and motivated team at Air Products delivered strong results. We had another quarter of excellent improvement in our safety performance. Adjusted EPS increased 15 percent over prior year, which is the 13th consecutive quarter of adjusted EPS growth, and we generated a significant amount of cash flow. In addition, our customers awarded us significant new orders, and we successfully started up our very large hydrogen plant in India and another very large oxygen plant in China.”

Investors looking for exposure to Air Products & Chemicals can invest in the PowerShares DWA Basic Materials Momentum Portfolio (PYZ). PYZ has invested 3.50% of its portfolio in Air Products & Chemicals. The fund’s other top holdings include Chemours (CC) and FMC (FMC) with weights of 4.80% and 4.50%, respectively, as of August 1, 2017.

In the next part, we’ll discuss how Air Products & Chemicals’ Industrial Gases-EMEA segment performed in fiscal 3Q17.