A Look at Consumer Expectations amid Risk Aversion

Consumer expectations for business conditions Consumer expectations form the only component of the Conference Board Leading Economic Index (or LEI) based on business expectations. Referring to consumer expectations regarding future economic conditions, their measurement is an average of two surveys. One survey, conducted by the Conference Board, records consumer expectations for business conditions six months […]

Aug. 29 2017, Updated 10:37 a.m. ET

Consumer expectations for business conditions

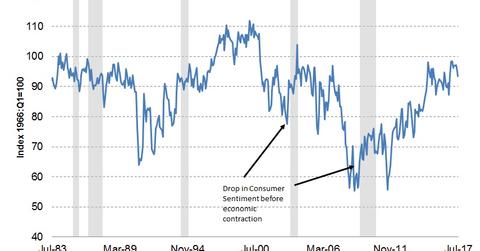

Consumer expectations form the only component of the Conference Board Leading Economic Index (or LEI) based on business expectations. Referring to consumer expectations regarding future economic conditions, their measurement is an average of two surveys. One survey, conducted by the Conference Board, records consumer expectations for business conditions six months ahead of the consumer confidence survey. The second survey collects consumer expectations for economic conditions 12 months ahead and is conducted by Reuters and the University of Michigan.

Recent data

According to the August LEI report, average consumer expectations for business conditions stood at 0.65 in July, compared with 0.36 in June. This increase was the first seen in four months. The constituent had a net contribution to the LEI of 0.09 points, or 9%, in July. An increase in average consumer expectations for business is a considered a positive sign for the US economy.

Conclusions

While the Conference Board report we’ve looked at was released in August, it contains data only for July. There have been a lot of developments in August that could impact the bond (SHY) (PCY), equity (QQQ), and currency markets (CEW). Whereas the objective of the Conference Board report is to signal business cycle changes, the recent developments relate to geopolitical issues. In the long run, economics are likely to prevail, but in the interim, we could be in for a season of volatility (VXX) after the summer lull.