Will Public Storage Ride High on Top Line in 2Q17?

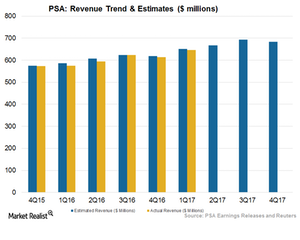

Wall Street expects Public Storage (PSA) to report revenue of $667.9 million for 2Q17. Its earnings call will be on July 27, 2017.

Jul. 24 2017, Updated 9:11 a.m. ET

Revenue expected in 2Q17

Wall Street expects Public Storage (PSA) to report revenue of $667.9 million for 2Q17. Its earnings call will be on July 27, 2017.

PSA’s revenue will likely remain flat, as higher occupancy is expected to be partially offset by moderation in rent growth. The industry as a whole is facing a slightly lower rent growth, after witnessing record rent increases over the past two years.

PSA is expected to report a revenue of $2.7 billion for fiscal 2017, which would be 0.1% higher YoY (year-over-year).

Location plays a key role in revenue growth

PSA has repositioned its properties in key cities close to the busiest industrial towns. There has been a secular shift in preference among REITs toward Class A cities that derive the highest demand. These locations offer proximity to sea ports, air ports, railway stations, and highways.

Drivers of revenue growth in 2Q17

Macroeconomic factors including high rent growth and secular shifts of demography toward high demand cities are expected to increase demand for PSA’s storage facilities. The company has thus undertaken several redevelopment initiatives for its facilities.

PSA is expected to witness higher rent growth in 2Q17, backed by higher occupancy and its consistent development and redevelopment activities.

1Q17 signified a strong start to 2017

In 1Q17, PSA’s witnessed a ~4% gain in same-store revenue, backed by higher same-store occupancy. The company’s locational advantages have helped it maintain demand for its properties.

Life Storage (LSI), Macerich (MAC), and Extra Space Storage (EXR) are expected to report revenues of $238.49 million, $237.29 million, and $131.31, respectively. Public Storage and Extra Space together make up 9% of the iShares Cohen & Steers REIT ETF (ICF).