Will OECD’s Crude Oil Inventories Fall below the 5-Year Average?

The EIA estimates that OECD’s crude oil inventories fell by 10.13 MMbbls (million barrels) to 3,005 MMbbls in June 2017—compared to May 2017.

Jul. 18 2017, Updated 2:05 p.m. ET

OECD’s crude oil inventories

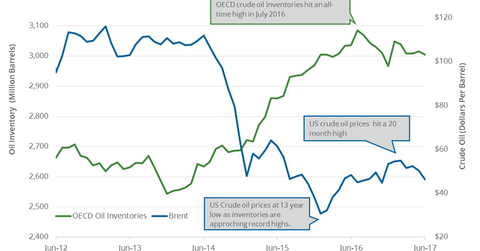

The EIA (U.S. Energy Information Administration) estimates that OECD’s (Organisation for Economic Cooperation and Development) crude oil inventories fell by 10.13 MMbbls (million barrels) to 3,005 MMbbls in June 2017—compared to May 2017. OECD’s oil inventories fell for the eighth time in the last ten months. Inventories are near a six-month low. The momentum could push OECD inventories below their five-year average.

OECD’s oil inventories fell 0.3% month-over-month and 1% year-over-year. The fall in oil inventories has a positive impact on crude oil (SCO) (BNO) (USL) (RYE) prices.

Higher crude oil prices have a positive impact on crude oil producers like PDC Energy (PDCE), Stone Energy (SGY), Continental Resources (CLR), and Cobalt International Energy (CIE).

IEA’s estimate

The IEA (International Energy Agency) estimates that OECD’s crude oil inventories fell in May 2017. However, OECD’s crude oil inventories are more than 3 billion barrels. They’re also 266 MMbbls higher than OPEC’s (Organization of the Petroleum Exporting Countries) five-year average.

EIA’s estimate

The EIA reported that OECD’s oil inventories averaged 2,970 MMbbls in 2015 and 2,967 MMbbls in 2016. The EIA estimates that OECD’s oil inventories will average 2,987 MMbbls in 2017—0.1% lower than previous estimates. The production cut deal and Saudi Arabia’s export plans could draw down global crude oil inventories.

The EIA estimates that OECD’s oil inventories will average 3,033 MMbbls in 2018—0.4% higher than previous estimates.

Impact of OECD’s crude oil inventories

The fall in OECD’s oil inventories in 2017 could help crude oil prices this year. However, a rise in OPEC and Russia’s crude oil production in 2018 would add to crude oil supplies and OECD’s crude oil inventories in 2018. A rise in crude oil production would pressure oil prices in 2018.

In the next part, we’ll discuss some crude oil price forecasts.