Why Ibrance Could Drive Pfizer’s Revenue Growth

In 2016, Pfizer’s (PFE) Ibrance reported revenues of ~$2.1 billion, compared with $723 million in 2015.

Jul. 24 2017, Updated 4:06 p.m. ET

Ibrance’s revenue trends

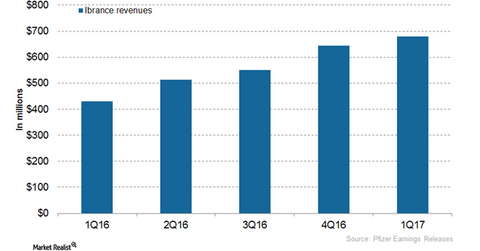

In 2016, Pfizer’s (PFE) Ibrance reported revenues of ~$2.1 billion, compared with $723 million in 2015. In 1Q17, Ibrance generated revenues of ~$679 million, which reflected a ~58% growth on a YoY (year-over-year) basis and 6% growth on QoQ (quarter-over-quarter) basis.

About Ibrance

Ibrance (palbociclib) is indicated for individuals who are hormone receptor (or HR)-positive, have human epidermal growth factor receptor 2 (or HER2) negative advanced, or have metastatic breast cancer. The drug is a kinase inhibitor used in combination with an aromatase inhibitor as a primary endocrine based therapy in postmenopausal women, or with fulvestrant in women who have demonstrated disease progression post-endocrine therapy.

In March 2017, the FDA (US Food and Drug Administration) approved the sNDA (supplemental new drug application) for Ibrance based on the positive results from a confirmatory phase-3 trial for Paloma-2. This regulatory approval broadens the range of anti-hormonal therapies that can be co-administered with Ibrance.

Previously, Ibrance was approved only in combination with letrozole, according to the first FDA approval of the drug in February 2015. Now, Ibrance can be administered with a wide range of aromatase inhibitors.

In February 2016, Ibrance received FDA approval for use in combination with fulvestrant for the treatment of women who have HR-positive, HER2 negative advanced, or metastatic breast cancer who have disease progression post-endocrine therapy.

Pfizer estimated that ~45,000 patients had been prescribed with Ibrance by ~9,000 providers since its launch in the US in February 2015. Currently, the Ibrance and letrozole combination is the most-prescribed FDA-approved oral combination therapy for HR positive, HER2, or negative metastatic breast cancer.

Market competition

In March 2017, the FDA-approved Novartis’ (NVS) Kisqali in combination with an aromatase inhibitor for the first-line therapy of postmenopausal women with HR positive, HER2 negative, or metastatic breast cancer. Pfizer could face stiff competition from Novartis’ Kisqali.

In April 2017, Eli Lilly (LLY) announced its interim analysis of its Monarch phase-3 trial with Abemaciclib for the treatment of HR positive, HER2 negative, or advanced breast cancer patients. The phase-3 Monarch trial achieved its primary endpoint, showing statistically substantial enhancement in progression-free survival (or PFS). The regulatory approval of the drug is expected to intensify the market competition.

Notably, the SPDR S&P 500 ETF (SPY) has ~0.95% of its total portfolio in Pfizer. SPY also has ~1.7% of its total portfolio holdings in Johnson & Johnson (JNJ), a peer in oncology drugs market.