Why IBM’s Earnings Could Fall Going Forward

International Business Machines (IBM) reported its 2Q17 results on Tuesday, July 18. The company reported falling quarterly profits and sales yet again.

Dec. 4 2020, Updated 10:53 a.m. ET

IBM’s revenues fell again

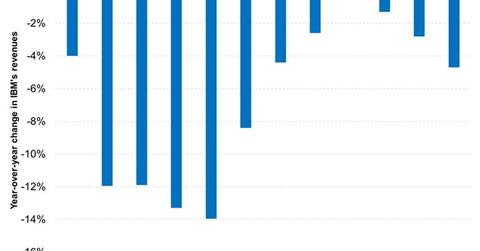

International Business Machines (IBM) reported its 2Q17 results on Tuesday, July 18. The 106-year-old company reported falling quarterly profits and sales yet again. The company saw its 21st consecutive quarter of falling revenues.

The company’s earnings beat analyst estimates, but revenues missed expectations. The tech giant reported earnings of $2.97 per share and revenues of $19.3 billion. Wall Street expected earnings of $2.75 per share and revenues of $19.5 billion. The company said its revenue in its strategic-initiative areas, which accounted for 43% of the company’s revenues over the past 12 months, rose 7% in 2Q17 compared to 12% growth in 1Q17.

IBM’s earnings could get squeezed

The company said a one-off tax benefit added $0.18 to the company’s quarterly EPS. Revenues fell 5% from the same quarter in the previous year, while profits fell 6.9% in the same timeframe. What’s worrying for IBM is that profit margins are narrowing across all verticals including cloud computing and artificial intelligence.

In the previous quarter, a three-percentage-point decline in the company’s gross profit margin spooked investors and dented hopes of a long-awaited turnaround. The latest results have further undermined those hopes. Tuesday’s results put more pressure on CEO Ginni Rometty to boost results in the rest of the year to meet the company’s full-year forecast.

IBM stock fell 3% after hours and has fallen 8% year-to-date. On the other hand, the tech sector as a whole has had a good year, surging around 21% compared to the S&P 500’s (SPY) (IVV) 9% gain.