What Will Drive Dunkin’ Brands’ 2Q17 Earnings?

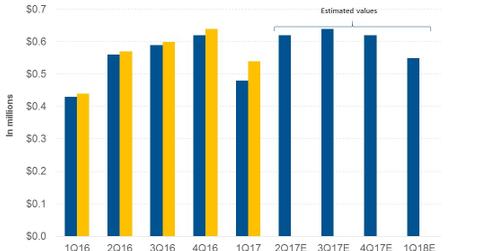

In 2Q17, analysts expect Dunkin’ Brands (DNKN) to post EPS (earnings per share) of $0.62, which represents a rise of 8.8% from its EPS of $0.57 in 2Q16.

Dec. 4 2020, Updated 10:53 a.m. ET

Earnings estimates

In 2Q17, analysts expect Dunkin’ Brands (DNKN) to post EPS (earnings per share) of $0.62, which represents a rise of 8.8% from its EPS of $0.57 in 2Q16.

This EPS growth is expected to be driven by Dunkin’s revenue growth, expansion in its EBIT (earnings before interest and tax) margin, and its lower effective tax rate.

Analysts expect the company’s effective tax rate to be 38.3%, compared to 38.9% in 2Q16. In the graph above, we can see that the company has outperformed analysts’ estimates in each of the last five quarters. When this happens, a company’s stock price tends to rise.

Peer comparison

In 2Q17, analysts expect Starbucks (SBUX), McDonald’s (MCD), and Wendy’s (WEN) to post EPS rises of 12.2%, 11.7%, and 10.5%, respectively.

For the next four quarters, analysts expect Dunkin’ Brands to post EPS of $2.43, which represents a rise of 3.4% compared to the corresponding quarters of the previous year. For 2017, the company’s management has set its EPS guidance in the range of $2.40–$2.43, which represents a rise in the range of 6.7%–8.9%.

Dividends

In 1Q17, Dunkin’ Brands paid total dividends of $0.32 at a dividend yield of 2.4% and a payout ratio of 53.1%. For the next three quarters, analysts expect the company to pay dividends of $0.97 to take the total for 2017 to $1.29, which represents a rise of 7.5% from $1.20 in 2016.

Next, we’ll look at Dunkin’ Brands’ valuation multiple.