US Crude Oil Inventories Could Fall below the 5-Year Average

The EIA estimates that US crude oil inventories fell by 4.7 MMbbls (million barrels) to 490.6 MMbbls on July 7–14, 2017.

Jul. 20 2017, Updated 11:35 a.m. ET

Crude oil prices

September WTI (West Texas Intermediate) crude oil (RYE) (XLE) (BNO) futures contracts fell 0.13% to $47.26 per barrel in electronic trading at 2:10 AM EST on July 20, 2017. Prices are near a six-week high due to improving crude oil demand.

Higher crude oil prices have a positive impact on oil producers such as QEP Resources (QEP), ConocoPhillips (COP), PDC Energy (PDCE), and Sanchez Energy (SN).

EIA’s crude oil inventories

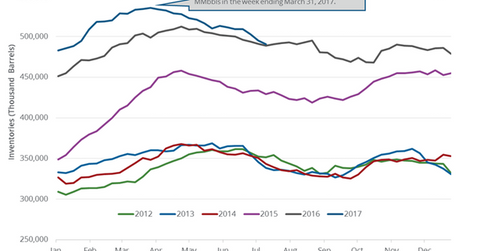

The EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report on July 19, 2017. The EIA estimates that US crude oil inventories fell by 4.7 MMbbls (million barrels) to 490.6 MMbbls on July 7–14, 2017. Inventories are at the lowest level since January 27, 2017. Inventories fell 1% for the week ending July 14, 2017—compared to the previous week. Inventories rose 0.3% from the same period in 2016.

A Wall Street Journal survey estimated that US crude oil inventories could have fallen by 3.1 MMbbls on July 7–14, 2017. US crude oil (SCO) (UCO) prices rose on July 19, 2017, due to the larger-than-expected fall in US crude oil inventories.

Impact of US crude oil inventories

US crude oil inventories have fallen 8.4% from the peak in March 2017. Inventories have fallen for the 14th time in the last 15 weeks. They have fallen by ~44.9 MMbbls or 8%. Saudi Arabia’s crude oil export plans could drain US crude oil inventories in the coming months. The momentum could push US crude oil inventories below their five-year average. The EIA estimates that US crude oil inventories could hit 477 MMbbls by December 2017. The fall in US inventories would help crude oil (PXI) (USL) (FENY) prices.

In the next part, we’ll look at why US crude oil production is important for oil prices.