Inside Kansas City Southern’s Trailer Decline Last Week

In the week ended July 8, 2017, Kansas City Southern (KSU) reported a marginal loss in its total intermodal volumes (containers and trailers).

Jul. 17 2017, Updated 10:42 a.m. ET

KSU’s intermodal traffic

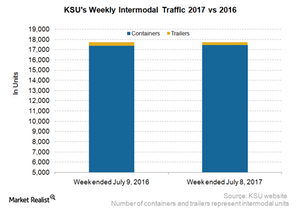

In the week ended July 8, 2017, Kansas City Southern (KSU) reported a marginal loss in its total intermodal volumes (containers and trailers). The company hauled ~18,000 intermodal units in the 27th week of 2017, which was similar to what we saw in the same week of 2016.

But last week, KSU saw a sharp fall in trailer volumes, though container volumes were slightly up. The company’s trailers recorded a 20.4% loss in volumes, whereas containers reported a 0.3% rise to 17,500 units.

Last week, KSU’s intermodal traffic direction came in contrast with the rise recorded by US railroads. But this was in line with the volume slump posted by Mexican railroads.

KSU’s intermodal business

In its 1Q17 conference call, KSU stated, “We have a positive outlook in our intermodal business, but it continues to see significant competitive pressure.”

This note shows that the company’s intermodal business faces severe pricing pressure. However, with its APM Terminal gearing up to full capacity, KSU’s intermodal business might see a solid lift soon.

Notably, KSU is the only Class I railroad that faces such stiff completion across all its segments. In the US, the company faces strong competition from BNSF Railway (BRK-B) and Union Pacific (UNP). In Mexico, KSU’s Mexican subsidiary, KCSM, competes with Landstar System (LSTR), Trinity Logistics, and ByExpress Logistics in the intermodal space.