Did the BOE and ECB Pressure the US Dollar This Week?

The currency markets are anticipating the June FOMC’s meeting minutes, which are expected to be hawkish.

Jul. 4 2017, Updated 7:40 a.m. ET

Fourth consecutive monthly loss for the US dollar

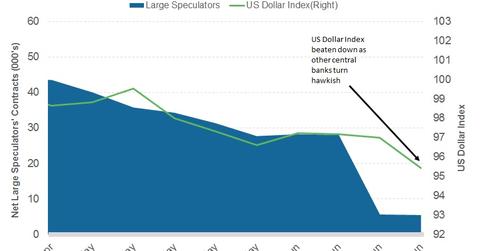

The US dollar index (UUP) had another bad week, losing over 1.5% for the week ended June 30, 2017. This is the fourth consecutive monthly loss for the US dollar index, with only February 2017 being a positive month.

The weakness in the dollar was not driven by domestic factors this week. Instead, it resulted from optimism from across the Atlantic. Central bankers in Europe and the UK surprised the markets with their hawkish comments, leading to the appreciation of their countries’ currencies.

The euro (FXE) gained ~2.1% against the US dollar in the previous week. The British pound (FXB) gained ~2.4% against the US dollar in the previous week.

Central bankers drove the dollar lower

Comments from the heads of the central banks in Europe and the UK indicated their inclination toward reducing their respective monetary stimulus programs. These comments gave an advantage to the euro and the pound against the dollar because the Fed’s optimistic outlook on the US economy is being questioned.

According to the latest Commitment of Traders report released by the Commodity Futures Trading Commission and calculations by Reuters, the US dollar’s (USDU) net long position fell to $4.5 billion through June 27, 2017, from ~$7.8 billion in the previous week. This trend represents the lowest level of net long positions in more than a year.

Fed meeting minutes and non-farm payrolls data ahead

The currency markets are anticipating the June FOMC’s[1. Federal Open Market Committee] meeting minutes, which are expected to be hawkish. The currency markets are also waiting for the June non-farm jobs data. This report would give markets an opportunity to assess whether the Fed is likely to follow through with additional rate hikes and balance sheet unwinding.

A strong jobs report could help the dollar recoup some of its losses, but the opposite would add to the downward pressure on the US dollar (UDN).

In the next part of this series, we’ll analyze the bond market’s reaction in a week that was influenced by central bankers.