Confused Markets: Inside the ECB’s Struggle amid Miscommunication

The ECB (European Central Bank) in its recent monetary policy meeting on June 8 left its main refinancing rate at 0% and the interest rate at 0.25%.

Jul. 5 2017, Updated 3:05 p.m. ET

The ECB’s stimulus program and the misinterpretation of Draghi

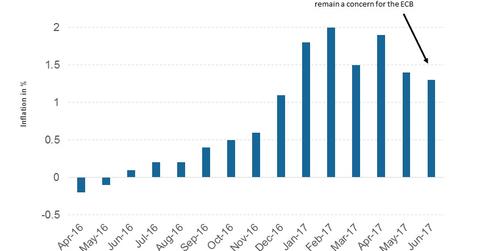

The ECB (European Central Bank) in its recent monetary policy meeting on June 8 left its main refinancing rate at 0% and the interest rate at 0.25%. According to the statement, the governing council expects interest rates to remain at these low levels for an extended period of time.

As for asset purchases, the current monthly pace of 50 billion euros is intended to be continued until the end of 2017. This information came as no shock, but in the last week of June, ECB President Mario Draghi hinted at a policy adjustment that took markets by surprise.

Draghi highlighted improved economic conditions and the favorable balance of risks, and his comments led to a widening of spreads in the Eurozone as well as a sharp rally in the euro (FXE), taking the shared currency to a one-year high of 1.1445 against the US dollar (UUP).

Correcting its message

The ECB had to correct markets’ interpretation of Draghi’s comments, however, by explaining the rationale behind the proposed policy change. A change in policy in the recovering Eurozone economy would effectively leave the stimulus unchanged, rather than amount to any tightening.

The euro has now corrected to 1.1330 from the one-year high of 1.1445 against the dollar (USDU) after the ECB’s latest efforts to correct its tapering message.

How European markets are likely to react now

Markets were quick to react to Draghi’s comments, with European equities trending lower and Eurozone government bonds tumbling. Any removal of stimulus by the ECB could cause European yields (IGOV) to increase and yield spreads between European countries to widen.

Hints about policy changes sent German bond (GGOV) futures lower, and the ten-year yield moved from 0.23% to 0.37%. Spreads widened as Italian bond yields moved ten basis points, Portuguese yields by seven basis points, and French yields by eight basis points. Bond yields (BWX) at the longer end of the curve will likely be hit harder by QE (quantitative easing) exit than the shorter end, and the impact would likely be more pressing in peripheral European countries.

Overall, Draghi’s comment about adjusting policy parameters is a signal that the ECB plans to move toward exit steps. Although the ECB signaled caution, the question is still this: What will really happen once the EU’s QE program runs out in January 2018?