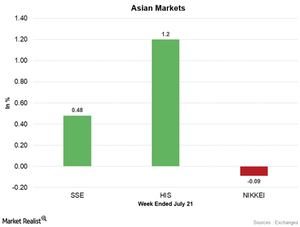

Asian Markets Were Stronger in the Week Ending July 21

China’s Shanghai Composite Index started the week ending July 21 weaker by falling to almost three-week low price levels on the first day of trading.

Jul. 24 2017, Published 8:58 a.m. ET

China

China’s Shanghai Composite Index started the week ending July 21 on a weaker note by falling to almost three-week low price levels on the first day of trading. However, the market regained strength as the week progressed amid improved market sentiment. The Shanghai Composite Index gained in three out of five trading days last week.

Despite stronger-than-expected GDP data, industrial production, and retail sales data, the Shanghai Composite Index fell during the first trading day last week amid comments from Chinese President Xi Jinping. President Xi Jinping called for the central bank to strengthen regulations to defend China’s economy against financial risks. As a result, regulatory concerns increased in the market. On the other hand, better-than-expected economic data at the beginning of the week improved the demand for blue-chip stocks. The China Blue-Chip Index rose to fresh 1.5-year high levels.

In the week ending July 21, the Shanghai Composite Index rose 0.48% and ended the week at 3,237.98. The SPDR S&P China ETF (GXC) rose 0.74% and ended last week at $94.98.

Hong Kong

The Hang Seng Index opened higher this week amid improved sentiment on Wall Street and China’s positive economic data. China’s strong GDP data increased hopes of higher money inflows into Hong Kong and pushed the market higher. With no major economic data from Hong Kong last week, the market was driven by global market sentiment, especially movements on Wall Street and in China. The Hang Seng Index rose 1.2% and closed last week at 26,706.09. The iShares MSCI Hong Kong ETF (EWH) rose 0.29% to $23.95 in the week ending July 21.

Japan

Japan’s markets were closed on the first trading day last week due to Ocean Day. Japan’s Nikkei Index fell on Tuesday to prices below the important level of 20,000 amid a rise in the yen and the decreased risk appetite. However, Nikkei regained strength as the week progressed and recaptured the 20,000 level. The improved risk appetite around the globe amid stronger-than-expected second quarter earnings supported Japan’s market last week. It fell 0.09% to 20,099.75 in the week ending July 21 and closed the week almost flat.

In the next part, we’ll discuss how European markets performed last week.