Why PPG Industries’ Interest Expense Is in a Declining Trend

In 2015, PPG’s interest expense dropped significantly. At the end of 2014, PPG refinanced $1.7 billion worth of notes that carried coupon rates of 9% and 7.7%, which reduced the interest expense.

Jun. 30 2017, Updated 9:08 a.m. ET

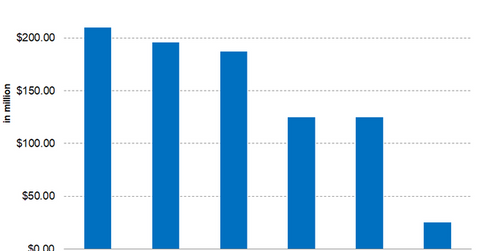

PPG Industries’ interest expense

In the previous part, we saw how PPG Industries’ (PPG) debt has remained steady since 2012. In this part, we’ll look into its interest expense trend. Although PPG’s debt was constant, PPG’s interest expense has been on a declining trend primarily due to PPG’s strategy of refinancing the notes that carry higher interest rates and replacing them with notes with lower coupon rates.

In 2015, PPG’s interest expense dropped significantly. At the end of 2014, PPG refinanced $1.7 billion worth of notes that carried coupon rates of 9% and 7.7%, which reduced the interest expense. In 1Q17 PPG’s interest expense was at $25 million, indicating that the interest expense might fall further in 2017.

PPG’s interest coverage ratio

The interest coverage ratio helps to understand how well a company can service its debt. It’s calculated by dividing EBIT (earnings before interest and taxes) by interest expense. The higher the multiple, the better it is for the company. At the end of 1Q17, PPG’s interest coverage ratio stood at 18.92x, suggesting that PPG can service debt 18 times its current interest expense.

Investors can indirectly hold PPG by investing in the Vanguard Materials ETF (VAW), which invests 3.4% of its portfolio in PPG. The top holdings of the fund include Dow Chemical (DOW), DuPont (DD), and Monsanto (MON), which have weights of 9.0%, 8.3%, and 6.1%, respectively, as of June 27, 2017.

In the next part, we’ll look into PPG’s latest analyst recommendations.