How Well Does American Tower Manage Its Balance Sheet?

AMT reported a debt-to-equity ratio of ~2.8x in 1Q17. The industry median debt-to-equity ratio is ~1.1x.

Jun. 14 2017, Updated 9:05 a.m. ET

Higher leverage is a prerequisite for expansion

In order to meet the requirement of paying at least 90% of their taxable income to investors as dividends, REITs like American Tower (AMT) depend on external debt. Moreover, REITs must opt for higher leverage to expand their real estate holdings. This increases their interest expenses, which could pressure their margins.

REITs require expansion in real estate holdings to create additional income sources. REIT managers work to maintain an optimal debt structure, which depends on how well the REIT converts its higher leverage to its advantage.

AMT’s consolidated debt in 2016 was $18.7 billion—higher than 2015’s debt level of $17.1 billion. Over the last five years, AMT’s long-term obligations, including its current obligations, have increased moderately from $8.7 billion in 2012 to $18.5 billion on December 31, 2016.

Debt-to-equity ratio

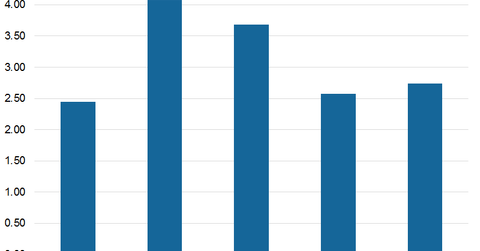

American Tower, which competes with REITs like SBA Communications Limited (SBAC), has been able to maintain a low debt-to-equity ratio in the last five years. AMT reported a debt-to-equity ratio of ~2.8x in 1Q17. The industry median debt-to-equity ratio is ~1.1x.

The chart above shows the trend of AMT’s debt-to-equity ratio for the past five years.

Among AMT’s peers, Crown Castle International (CCI), Realty Income (O), and Simon Property Group (SPG) have debt-to-equity ratios of ~1.6x, ~0.86x, and 5.3x, respectively. American Tower, Crown Castle, and Simon Property Group comprise 17% of the PowerShares Active US Real Estate ETF (PSR).

Average interest rates

The weighted average risk-free interest rate was ~1.4% in 2016, ~1.6% in 2015, and ~1.6% in 2014.

In the next part of this series, we’ll examine AMT’s valuation in comparison to its peers.