Why Are Bond Traders Increasing Their Net Positions?

US bond markets are trading on the expectation of an interest rate hike by the US Federal Reserve in June 2017. Last week, bond yields extended their slides.

May 16 2017, Published 4:21 p.m. ET

Markets continue guessing about the June hike

US bond markets are trading on the expectation of an interest rate hike by the US Federal Reserve in June 2017. Last week, bond yields extended their slides due to lower-than-expected business inventory and Michigan sentiment readings, which were followed by lower retail sales and inflation numbers.

The two-year yield (SHY) fell to 1.30% compared to 1.34% a week earlier, the five-year yield fell to 1.85% from 1.91%, and the ten-year yield (IEF) fell to 2.33% compared to its previous high of 2.38%.

Bond bets continue to rise

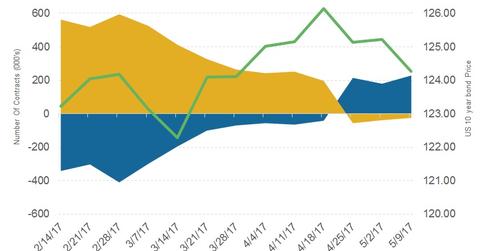

According to the Commitment of Traders report released by the Commodity Futures Trading Commission (or CFTC) on May 12, 2017, traders and large speculators continued to increase their long positions on ten-year bonds.

Rising net long positions indicate that investors are anticipating further rises in bond (BND) prices and falls in bond yields. Speculators’ current view is surprising given that the markets are pricing in a rate hike for June. A rate hike would likely move yields higher (HYG) and bond prices lower.

Non-commercial futures for ten-year bonds, which are traded by hedge funds and large speculators, had a total net position of 229,000 contracts as of May 9, a rise of 49,249 contracts compared to the previous week.

Treasury action this week

The usual monthly and weekly Treasury auctions will continue this week with the announcements of auctions for two-year, five-year, and seven-year Treasuries (IEI).

A few Federal Reserve speakers are also lined up for this week. Cleveland Fed president Loretta Mester will be speaking about monetary policy and the economic outlook on May 18, and St. Louis Fed president James Bullard will share his thoughts on policy and the economy on May 19.

US economic data and overall the market sentiment are likely to be the key drivers of the bond markets this week.