The North Face and Vans Drive VF Corporation’s 1Q17 Top Line

VFC’s Outdoor & Action Sports segment, which mainly focuses on Vans, The North Face, and Timberland, recorded a 2.1% YoY rise in sales to $1.7 billion.

May 3 2017, Updated 7:37 a.m. ET

VF Corporation’s segments

Let’s look now at the 1Q17 performance of VF Corporation’s (VFC) largest business segment—Outdoor & Action Sports.

VFC operates through four major business segments, called coalitions:

- Outdoor & Action Sports

- Jeanswear

- Imagewear

- Sportswear

Outdoor & Action Sports accounted for 65.0% of the company’s business in 1Q17.

The North Face and Vans post a solid quarter

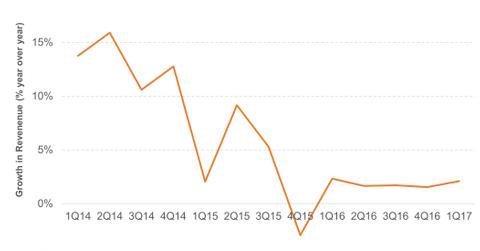

VFC’s Outdoor & Action Sports segment, which mainly focuses on Vans, The North Face, and Timberland brands, recorded a 2.1% YoY (year-over-year) rise in sales to $1.7 billion. On a currency-neutral basis, sales rose 4.0%.

Revenue for The North Face brand rose 8.0% YoY, which was better than the company’s expectations. While sales for America (4.0% rise YoY) and Europe (19.0% rise YoY) showed strength, there was a slight fall in Asia-Pacific (1.0% fall YoY). Growth in America was driven by a low-teen growth in direct-to-customer sales. On the other hand, growth in Europe was anchored by a 30.0% growth in the wholesale business.

Global revenue growth for the Vans brand remained steady. Sales rose 7.0% YoY during the quarter, driven by strong performances in America (6.0% rise YoY) and Asia (20.0% rise YoY), especially through the direct-to-customer channel. Sales for e-commerce were particularly strong, rising 20.0% in America and 30.0% in Europe.

Revenue for the Timberland brand, however, fell 4.0% YoY as a low single-digit rise in direct-to-customer sales was offset by a high single-digit fall in wholesale revenues. Sales in America and Asia fell 7.0% and 5.0%, respectively, while the European business remained flat.

If you want exposure to VFC, you can consider the PowerShares High Yield Equity Dividend Achievers ETF (PEY), which invests 1.8% of its portfolio in VFC.

In the next part of this series, we’ll look at the performance of the company’s Jeanswear, Imagewear, and Sportswear segments.