How Higher Inflows to China Could Impact Other Emerging Markets

With the onset of reforms, foreign holdings in China’s onshore bond (EMB) (PCY) market is gradually increasing.

May 31 2017, Updated 9:07 a.m. ET

VanEck

China’s Impact on Emerging Markets Bond Indices

Barring what would be a significant step backwards by Chinese policymakers, index inclusion appears inevitable at some point in the foreseeable future. The impact will be significant, with inflows expected to be in the range of US$150 to $300 billion from emerging markets and global bond funds, mostly the latter. Although flows could initially be subdued if active managers choose to underweight China, flows would be increased to the extent that onshore bonds are added to off-benchmark exposures. From an emerging markets index perspective, the higher allocations to China would come at the expense of relatively smaller issuers including Poland, Indonesia and South Africa.

Market Realist

Higher inflows into China could result in reallocation of capital among emerging markets

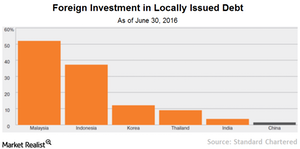

With the onset of reforms, foreign holdings in China’s onshore bond (EMLC) (EMAG) (IGEM) (PCY) market is gradually increasing. Although foreign holdings increased 10.6% to 870.0 billion yuan in 2016 over the previous year, it’s still small compared to the size of China’s onshore bond market and other prominent emerging markets. According to data from the State Administration of Foreign Exchange, the size of China’s onshore bond market is 64.0 trillion yuan.

Expect more inflows

As the Chinese bond market becomes more transparent, more global index providers are likely to include China’s onshore bonds in their prominent global indexes. The inclusion of China’s onshore bonds (EMLC) in global indexes would significantly boost the flow of funds from global investors into China over the long run. According to Goldman Sachs, if China’s onshore bonds (ELD) (LEMB) were to be included in three major benchmarks—the JPMorgan GBI-EM (Government Bond Index-Emerging Markets) Global Diversified Index, the Citigroup World Government Bond Index, and the Bloomberg Barclays Global Aggregate Index—that would result in inflows in China worth about $250.0 billion.

Such a huge inflow into China would adversely affect the inflows into other emerging markets due to commensurate lower allocations to markets offering lower relative yields and lesser liquidity. The smaller markets are likely to witness less capital allocation as a result.