Disney’s Stock Price: Identifying the Key Drivers

The Walt Disney Company (DIS) announced its fiscal 2Q17 results on May 9. The company’s stock price closed at $109.58 on May 11, 2017.

May 17 2017, Updated 7:35 a.m. ET

Disney’s rising stock

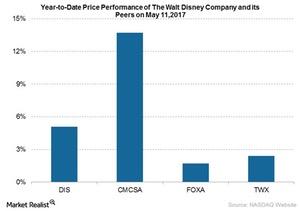

The Walt Disney Company (DIS) announced its fiscal 2Q17 results on May 9. The company’s stock price closed at $109.58 on May 11, 2017. The stock has fallen 1.7% since the results were announced and fallen by 3.1% in the past month. Disney’s stock price has risen 5.1% year-to-date. In contrast, Comcast (CMCSA) and Time Warner (TWX) have risen 13.7% and 2.4%, respectively, year-to-date. Twenty-First Century Fox (FOXA) stock has risen 1.7% year-to-date.

Factors impacting Disney stock

Disney recorded revenues of $13.3 billion in fiscal 2Q17, up 3% year-over-year, and an operating income of $3.9 billion, a rise of 5% over fiscal 2Q16. The company announced diluted EPS (earnings per share) of $1.50, exceeding consensus Wall Street analysts’ estimates of $1.41. The results haven’t seemed to curtail investors’ fears, as the company’s stock price has fallen 1.7% since the results were announced. Investors continue to worry about ESPN.

Recently, Disney initiated layoffs at ESPN to curtail rising costs. The company is also looking at monetizing its content effectively through digital distribution. Even though Disney remains optimistic about the fate of ESPN on OTT (over-the-top) platforms, the rising costs of sports programming aren’t helping the network.

In fiscal 2017, the company expects modest growth for EPS as a result of rising programming costs and its decision to release fewer movies this year. Its Studio Entertainment segment is expected to release only seven movies this year, compared to 12 movies in fiscal 2016.

The company expects its Consumer Products segment to have a strong fiscal performance in the second half of 2017, driven primarily by its intellectual properties such as Cars and Spider-Man.

Disney makes up 0.7% of the SPDR S&P 500 ETF (SPY). SPY has holdings of 4.3% in the computer sector.