Are Investors Disappointed with DuPont’s Dividend Rate?

On April 26, 2017, DuPont (DD) declared a dividend of $0.38 per share on its outstanding common stock for fiscal 2Q17. The dividend will be payable on June 12, 2017.

May 31 2017, Updated 5:05 p.m. ET

DuPont’s fiscal 2Q17 dividend

On April 26, 2017, DuPont (DD) declared a dividend of $0.38 per share on its outstanding common stock for fiscal 2Q17. The dividend will be payable on June 12, 2017.

DuPont has set May 15, 2017, as the record date. However, it should be noted that DuPont hasn’t raised its regular cash dividend since fiscal 3Q15.

Dividend growth

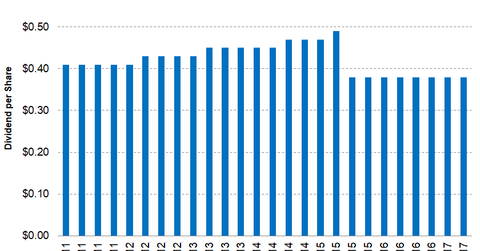

DuPont’s investors were disappointed with the company when it reduced its dividend from $0.49 per share in fiscal 2Q15 to $0.38 per share in fiscal 3Q15.

Since then, DuPont hasn’t raised its regular quarterly cash dividend. From fiscal 2011 to fiscal 2016, DD’s dividend rate fell 1.6%. DuPont’s peer Dow Chemical (DOW) has seen its dividend rise at a CAGR (compound annual growth rate) of 15.4% in the past five years.

DuPont’s free cash flow

It’s important for investors to know whether a company is generating enough free cash flow to sustain its dividend growth, as dividends are usually paid out of free cash flow.

In the past six years, DuPont’s free cash flow has been very inconsistent. For our analysis, we’ll consider the free cash flow generated by DuPont and convert it to free cash flow per share.

DuPont’s free cash flow per share fell from $3.51 in fiscal 2011 to $2.60 in fiscal 2016, which could be the reason why DuPont’s dividend has fallen in the past two years.

Investors can gain exposure to DuPont through the Vanguard Materials ETF (VAW), which invests 8.2% of its holdings in DuPont. The fund’s top holdings include Monsanto (MON) and Praxair (PX), which have weights of 6.2% and 4.5%, respectively, in the ETF, as of May 30, 2017.

In the next article, we’ll look into DuPont’s dividend payout and current dividend yield.