Analysts’ Ratings for Phillips 66 after Its 1Q17 Earnings

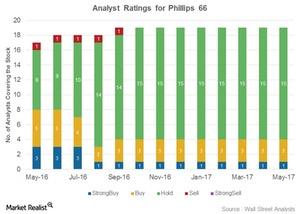

After its earnings, Phillips 66 was rated by 19 analysts. Four analysts gave it a “buy,” 15 gave it a “hold,” and no analysts gave it a “sell.”

May 2 2017, Updated 9:35 a.m. ET

Analysts’ ratings

So far in this series, we examined Phillips 66’s (PSX) 1Q17 earnings versus estimates. We also analyzed Phillips 66’s segmental performance and refining margin trend in 1Q17. We discussed the company’s stock performance after its earnings release on April 28, 2017. In this part, we’ll look at analysts’ ratings for Phillips 66.

After its earnings, Phillips 66 was rated by 19 analysts. Four (or 21%) analysts gave it “buy” or “strong buy” ratings, 15 (or 79%) gave it “hold” ratings, and no analysts gave it “sell” or “strong sell” ratings.

Phillips 66 could witness a revision in its ratings as analysts drill further down its 1Q17 numbers. Phillips 66’s mean target price of $88 per share indicates an 11% gain from the current level.

Analysts’ ratings for peers

Phillips 66’s peers Tesoro (TSO), Valero Energy (VLO), and Marathon Petroleum (MPC) have been rated as a “buy” by 67%, 57%, and 90% of the analysts, respectively. Other downstream players like HollyFrontier (HFC), Delek US Holdings (DK), Alon USA Energy (ALJ), and Western Refining (WNR) have been rated as a “buy” by 29%, 33%, 11%, and 17% of the analysts, respectively.

For small-cap, value stocks exposure, you can look at the iShares Russell 2000 Value ETF (IWN). IWN also has ~5% exposure to energy sector stocks including Delek US Holdings, Western Refining, and Alon USA Energy. If you’re looking for exposure to mid-cap stocks, you can consider the SPDR S&P MIDCAP 400 ETF (MDY). MDY also has ~3% exposure to energy sector stocks including HollyFrontier and Western Refining.

In the next part, we’ll look at the change in implied volatility in Phillips 66 after its 1Q17 earnings.