Why the Numbers Look Bearish for These Upstream Stocks

All these upstream companies have seen the short interest in their stocks rise—an potential indication of market skepticism in these companies’ abilities to profit from oil’s recent gains.

Dec. 4 2020, Updated 10:53 a.m. ET

Upstream stocks with high short interest

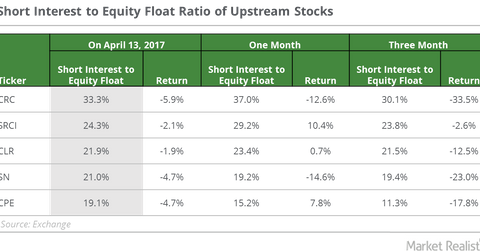

On April 13, 2017, California Resources (CRC) had the highest short-interest-to-equity float ratio among the upstream stocks in the SPDR S&P Oil & Gas Exploration & Production ETF (XOP) at ~33.3%.

California Resources’ short-interest-to-equity float ratio has risen 10.4% over the past three months. During this period, the stock has fallen 33.5%. The company’s net-debt-to-EBITDA (earnings before interest, tax, depreciation, and amortization) ratio is now 15.8x.

In the past four quarters, California Resources’ revenue fell 20.2%. It reported no operating income on an adjusted basis in 4Q16, as compared to an adjusted operating loss of $5 million in 4Q15. CRC’s operating profit margin is now -5.5%, as compared to the industry median of 4.9%.

California Resources was among the high implied volatility stocks that we discussed in Part 2 of this series. Remember, expectations of large movements in a stock can increase implied volatility, while high short interest in a stock reflects traders’ expectations of a downside in the stock.

SRC Energy

SRC Energy’s (SRCI) short-interest-to-equity-float ratio is currently ~24.3%. SRC Energy has fallen 2.6% in the past three months, and its short-interest-to-equity float ratio has risen 1.8% during the same period. SRC Energy (SRCI) was formerly known as Synergy Resources (SYRG).

In the past four quarters, the company has increased its revenues by 48.5%. It reported an adjusted operating income of $9.4 million in 4Q16, as compared to an adjusted operating loss of $10.3 million in 4Q15. SRC Energy’s operating profit margin is now -12.6%.

Continental Resources

Continental Resources’ (CLR) short-interest-to-equity-float ratio is ~21.9%. Its stock has fallen 12.5% in the past three months, and the stock’s short-interest-to-equity-float ratio has risen 2.3% during the same period. CLR’s net-debt-to-EBITDA ratio is now 4.9x.

In the past four quarters, Continental Resources’ revenue has risen 6.8%. It incurred an operating loss of $13.3 million in 4Q16, as compared to its operating loss of $62 million in 4Q15. Continental Resources’ operating profit margin is now -18.1%.

Sanchez Energy

Sanchez Energy’s (SN) short-interest-to-equity float ratio is now ~21%. Its net-debt-to-EBITDA ratio is 8.3x. The stock has fallen 23% in the past three months, while its short-interest-to-equity float ratio has risen 8.3% during the same period. (SN was among the high volatility upstream stocks that we discussed in Part 1 of this series.)

Callon Petroleum

Callon Petroleum‘s (CPE) short-interest-to-equity float ratio is currently ~19.1%. In the past three months, the stock has fallen 17.8%, while its short-interest-to-equity float ratio has risen 69.6% during the same period.

In the past four quarters, CPE’s revenue has more than doubled. It reported a rise of 10.9x in its adjusted operating profit in 4Q16, as compared to 4Q15. Callon Petroleum Company’ operating profit margin is now 25.9%.

Notably, all of the above companies have seen the short interest in their stocks rise during the past three months, and this could be an indication of market skepticism in these companies’ abilities to profit from oil’s recent gains, or from oil gains in general.

For more on this industry, check out Market Realist’s quantitative analysis of crude oil prices on Wednesdays.