Why Kansas City Southern’s Energy Revenue Rose 64% in 1Q17

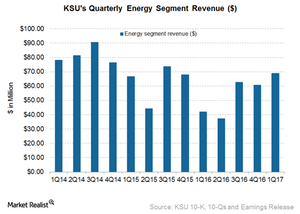

In this article, we’ll examine Kansas City Southern’s (KSU) Energy freight revenue in 1Q17. In the quarter, KSU’s Energy freight revenue was $69.0 million.

Apr. 25 2017, Updated 10:37 a.m. ET

Kansas City Southern’s Energy segment

In this article, we’ll examine Kansas City Southern’s (KSU) Energy freight revenue in 1Q17. In the quarter, KSU’s Energy freight revenue was $69.0 million, a rise of 64% compared to $42.0 million in the same period last year.

Energy freight volumes

In 1Q17, overall Energy carloads rose 30% compared to 1Q16. More importantly, the segment’s revenue per unit rose an impressive 26% in 1Q17, the highest among all freight commodities. The company believes it’s a “paradise gained” for coal and that the 40% rise in utility coal volumes signifies the return of coal.

Even volumes of fractionating sand rose 60% on account of the increased rig count and a relative rise in crude prices compared to 1Q16. However, crude oil volumes fell 23% in the quarter, weakening the crude-by-rail story.

Management’s outlook

Kansas City Southern foresees a recovery in the energy market driven by increased natural gas prices and reduced inventories, leading to higher demand for coal. The resurrection in drilling activity and higher rig counts throughout 2017 are expected to boost the transportation of fractionating sand.

Kansas City Southern anticipates increased shipments of LPG (liquefied petroleum gas) and refined products into Mexico, mainly due to the Mexican energy reforms slated to be implemented in the current year. KSU’s refined products terminal in San Luis Potosi is expected to move its first shipment in 2Q17. The open fuel market policy will bring more freight volumes for the company’s Mexican operations in 2017.

Peers’ energy freight prospects

Crude oil price levels currently aren’t enough to support the crude-by-rail story. If crude oil prices rise going forward, it should boost the top lines of KSU and peers. Its the Eastern United States, KSU’s peers include Norfolk Southern (NSC) and CSX Corporation (CSX).

In the Midwest, the company competes with Union Pacific (UNP) and BNSF Railway (BRK-B). All these railroad companies are expected to face strong headwinds in the energy market over the next year.

All US-originated Class I railroad companies are part of the iShares Global Industrials ETF (EXI).

In the next article, we’ll review KSU’s Intermodal segment’s 1Q17 performance.