Valero’s Institutional Holdings before the 1Q17 Results

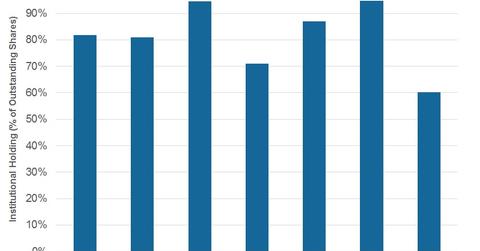

The institutional holdings in Valero Energy (VLO) are higher than the institutional holdings in Marathon Petroleum (MPC), Phillips 66 (PSX), and Western Refining (WNR).

Nov. 20 2020, Updated 4:57 p.m. ET

Institutional holdings in VLO

Institutional holdings in Valero Energy (VLO) now stand at ~82%. The level of these holdings suggests the confidence level or sentiment that sophisticated market participants such as institutions have in the stock.

Peer institutional holdings

The institutional holdings in Valero are higher than the institutional holdings in Marathon Petroleum (MPC), Phillips 66 (PSX), and Western Refining (WNR), which have institutional holding levels of 81%, 71%, and 60%, respectively. Usually, everything else being equal, higher institutional holdings indicate a generally favorable opinion about a stock.

HollyFrontier’s (HFC) and Delek US Holdings’ (DK) institutional holdings stand at 87% and 95%, respectively.

If you’re looking for exposure to mid-cap stocks, you might consider the SPDR S&P MIDCAP 400 ETF (MDY). MDY has ~4% exposure to the energy sector stocks, including HFC and WNR.

For ongoing updates on this industry, keep checking in with Market Realist’s Energy and Power page.