US Gasoline Demand Might Support Crude Oil Bears

The EIA estimated that four-week average US gasoline demand fell by 6,000 bpd (barrels per day) to 9,306,000 bpd from March 24–31, 2017.

Nov. 20 2020, Updated 4:41 p.m. ET

US gasoline demand

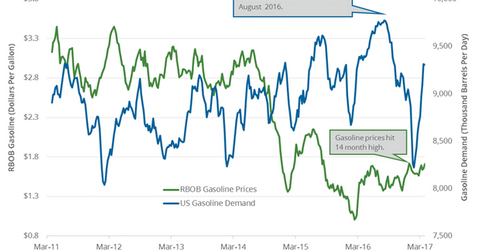

The EIA (U.S. Energy Information Administration) estimated that four-week average US gasoline demand fell by 6,000 bpd (barrels per day) to 9,306,000 bpd from March 24–31, 2017. US gasoline demand fell 0.1% week-over-week and 0.5% year-over-year. US gasoline demand fell for the second time in the last ten weeks. The fall in gasoline demand is bearish for gasoline and crude oil (XES) (VDE) (DIG) prices. For more on crude oil prices, read Part 1 and Part 2 of this series.

Lower gasoline and crude oil (FENY) (RYE) (IXC) prices have a negative impact on refiners and oil producers’ earnings like Marathon Petroleum (MPC), Tesoro (TSO), Bonanza Creek Energy (BCEI), Goodrich Petroleum (GDP).

Gasoline prices

US gasoline prices hit $1.14 per gallon on March 15, 2016—the lowest price in 12 years. As of April 11, 2017, prices have risen 53.5% from their lows in February 2016 due to the increase in gasoline demand. Rising gasoline demand partially supported crude oil prices as well. US crude oil prices rose ~103% during the same period. Changes in gasoline demand drive gasoline inventories. For updates on gasoline inventories, read the previous part of the series.

US gasoline consumption estimates for 2017

The EIA estimates that US gasoline consumption will average 9,300,000 bpd and 9,340,000 bpd in 2017 and 2018, respectively. US gasoline consumption figures for 2018 will be the highest ever.

US gasoline consumption averaged 9,330,000 bpd and 9,180,000 bpd in 2016 and 2015, respectively. US gasoline consumption hit a record in 2016. High gasoline consumption over the long term should have a positive impact on gasoline and crude oil prices.

Read What Can Investors Expect in the Crude Oil Market in 2017 and Russia, Libya, and Syria Boost Crude Oil Prices for more on crude oil prices.

Read Will Crude Oil Prices Test 3 Digits Again? for more on crude oil price forecasts.

For more industry analysis, visit Market Realist’s Energy and Power page.