High Yield Bonds: Are Rising Rates a Risk?

AB Are Rising Rates a Risk? Investors thinking about introducing high-yield bonds into an asset allocation might ask if it’s the right time to invest in them. With interest rates at historic lows, won’t there be substantial risk to high-yield bonds when rates begin to rise again? It’s a fair question, and there are risks […]

Apr. 11 2017, Updated 9:06 a.m. ET

AB

Are Rising Rates a Risk?

Investors thinking about introducing high-yield bonds into an asset allocation might ask if it’s the right time to invest in them. With interest rates at historic lows, won’t there be substantial risk to high-yield bonds when rates begin to rise again?

It’s a fair question, and there are risks investors should be aware of. As we stated earlier, high-yield bonds’ sensitivity to rising rates is at its greatest when credit spreads are narrow. And over the last few years, high demand from investors struggling to find yield in other bond sectors has caused spreads to shrink considerably, and dip below their historical average.

It’s certainly possible that a rapid increase in economic growth could lead high-yield bonds to be more sensitive to rising interest rates than our historical analysis indicates. In that scenario, we’d expect high-yield bonds to underperform equities.

On the other hand, a more modest rate of growth—the sort of steady but subdued expansion we’ve seen for several years now—should enhance high yield’s appeal.

Tighter high-yield spreads also mean that most returns will likely come from high yield bonds’ regular coupon payments. It’s worth pointing out that this wouldn’t be a big departure from 2013, when high-yield delivered a total return of 7.4%, with an average coupon of 7.3%.

Most importantly, we think that the decision to add high yield to an asset allocation should be based on a long-term portfolio-construction perspective. On that score, high yield retains the ability to dampen portfolio volatility without sacrificing much in the way of returns.

Market Realist

High yield bonds are less affected by rising interest rates

Interest rate fluctuations have major ramifications for bond investments. A rise in interest rates causes bond prices to fall, and vice versa. This relationship is applicable to all the fixed income classes. However, bonds with longer maturities are more prone to changes in interest rates than short-term bonds. In the present scenario, while rising interest rates remain a concern, it should be noted that high yield bonds are less affected by an increase in interest rates than investment grade bonds due to their low correlation to Treasuries.

In fact, rising rates can be beneficial to high yield bonds (HYG) (JNK). The improving economic scenario leads to higher rates, which help boost corporate earnings. As corporate earnings start to improve, corporate default rates decline. Moreover, high yield bonds are issued for a shorter duration than high-grade bonds because of higher coupons.

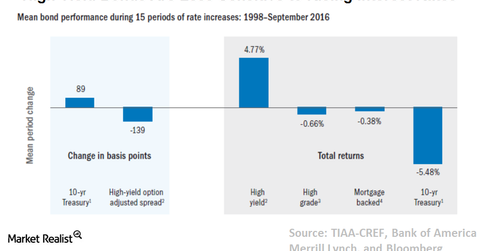

Historically, it has been observed that high yield bonds (PHB) (SJB) have generated higher returns when interest rates rise gradually. According to a TIAA and Bank of America Merrill Lynch analysis, the ten-year Treasury note’s yields rose more than 50 basis points on 15 different occasions between January 1998 and September 2016. Analysis revealed that high yield bonds’ (HYS) average total returns have not experienced any substantial impact, despite the rise in yields. The impact on Treasuries and investment-grade corporate bonds was greater. As shown in the chart above, an 89-basis-point increase in yield on the ten-year Treasury note led to a -0.66% return on investment-grade corporate bonds, while high yield bonds generated a higher return of 4.8%.