Novartis’s 1Q17 Earnings: Innovative Medicines Segment

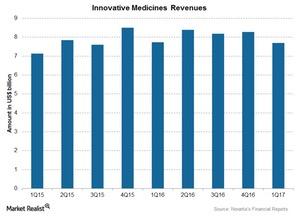

Novartis’s (NVS) Innovative Medicines segment contributed ~66.6% to overall 1Q17 revenue, or $7.7 billion.

Apr. 27 2017, Updated 5:05 p.m. ET

The Innovative Medicines segment

Novartis’s (NVS) Innovative Medicines segment, formerly the Pharmaceuticals segment, consists of products for therapeutic areas including oncology, cardiometabolic, immunology, dermatology, retina, respiratory, neuroscience, and established medicines. The overall contribution of the segment was ~66.6% at $7.7 billion for 1Q17.

The segment includes two business units: Novartis Pharmaceuticals and Novartis Oncology.

Performance of key products

The segment’s revenues rose 7.0% due to volume growth, offset by a 4.0% fall due to generic competition and a 1.0% fall due to the pricing of Gleevec/Glivec in the United States and Europe.

Growth drivers included Gilenya, Tasigna, Cosentyx, Ilaris, Exjade, Tafinlar and Mekinist combination, Promacta, Jakavi, Galvus, Exforge, Entresto, and some respiratory products.

Gilenya (fingolimod) is an oral therapy for multiple sclerosis. Due to increased demand, revenues rose 5.0% at constant exchange rates to $722.0 million in 1Q17, compared to $698.0 million in 1Q16. Gilenya reported double-digit growth in most of the markets. It competes with Biogen’s (BIIB) Tecfidera (dimethyl fumarate) and Sanofi’s (SNY) Aubagio (teriflunomide).

Tasigna (nilotinib), a drug for the treatment of chronic myeloid leukemia, reported a 9.0% rise in revenues at constant exchange rates to $411.0 million in 1Q17. That following increased sales in both the US and global markets. Tasigna competes with Pfizer’s (PFE) Bosulif (bosutinib).

The Tafinlar (dabrafenib) and Mekinist (trametinib) combination is used in the treatment of BRAF V600+ metastatic melanoma. The combination is approved in more than 60 countries for the treatment of unresectable melanoma, and in 35 countries for the treatment of metastatic melanoma. The combination reported a growth in revenues to $187.0 million in 1Q17 compared to $150.0 million in 1Q16.

Cosentyx (secukinumab) revenues rose more than 100.0% to $410.0 million in 1Q17 compared to $176.0 million in 1Q16.

To divest the risk, investors can consider ETFs such as the PowerShares International Dividend Achievers ETF (PID), which holds 1.1% of its total assets in Novartis.