What Impacted Constellation Brands’ 4Q Wine and Spirits Sales?

In the full-year fiscal 2017, Constellation Brands’ Wine and Spirits segment’s sales rose 6.0% to $3.1 billion.

Apr. 11 2017, Updated 9:06 a.m. ET

Wine and spirits sales

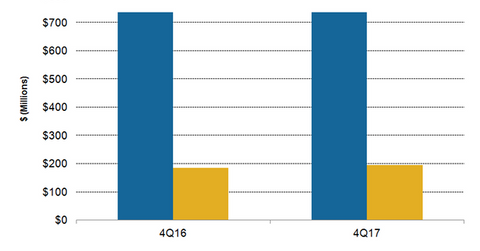

In the previous part of this series, we discussed the strong growth of Constellation Brands’ (STZ) Beer segment in fiscal 4Q17. However, sales of the company’s Wine and Spirits segment were flat during the quarter. The 4.0% rise in the segment’s organic net sales and the sales contribution from Prisoner, Charles Smith, and High West acquisitions were offset by the divestiture of the company’s Canadian wine business in fiscal 4Q17.

Constellation Brands sold its Canadian wine business to Ontario Teachers’ Pension Plan on December 17, 2016. The sale resulted in a net gain of $262 million, which was recorded in fiscal 4Q17. Constellation Brands sold its Canadian wine business as a part of its strategy to focus on higher growth and higher-margin businesses. Constellation Brands accounts for 5.8% of the PowerShares Dynamic Food & Beverage (PBJ). The segment’s operating margin rose 6.5% to $196.1 million in fiscal 4Q17.

Wine and spirits sales in fiscal 2017

In the full-year fiscal 2017, Constellation Brands’ Wine and Spirits segment’s sales rose 6.0% to $3.1 billion. The segment’s top-line growth during the year was driven by higher organic sales and the acquisition of Meiomi and Prisoner brands.

Constellation Brands has made a series of acquisitions in the higher-margin premium category of wines and spirits. Constellation Brands acquired the Charles Smith Wines business in October 2016. The acquisition included a collection of five super and ultra-premium wine brands. In April 2016, the company acquired the Prisoner wines portfolio, which consisted of five super-luxury wine brands. In October 2016, the company acquired High West Holdings. The acquisition included a portfolio of craft whiskeys and other select spirits. These acquisitions are expected to drive the segment’s future growth.

For fiscal 2018, Constellation Brands expects the sales of the Wine and Spirits segment to fall 4.0% to 6.0%. The segment’s operating income is expected to be flat in fiscal 2018. The expected decline in the segment’s fiscal 2018 sales is due to the impact of the divestiture of the company’s Canadian wine business.

Let’s look at the margins of Constellation Brands in the next part of this series.