Why High-Yield Bonds Are Needed in a Portfolio

AB Summing It Up High-yield bonds present an alternative for investors at an uncertain crossroads. Equity valuations seem attractive based on some measures, but volatility has led many investors to search for ways to temper the risk in their portfolios. At the same time, bonds—a popular risk reducer—are less attractive than normal due to extremely […]

Apr. 12 2017, Updated 7:36 a.m. ET

AB

Summing It Up

High-yield bonds present an alternative for investors at an uncertain crossroads. Equity valuations seem attractive based on some measures, but volatility has led many investors to search for ways to temper the risk in their portfolios. At the same time, bonds—a popular risk reducer—are less attractive than normal due to extremely low yields.

High yield’s strong risk-adjusted return potential and complementary nature to both stocks and investment-grade bonds argue for a different perspective. Instead of stereotyping high-yield bonds because they “look like bonds,” our research suggests that investors should consider high-yield bonds as a worthy replacement for part of a portfolio’s equity exposure—or even as a stand-alone allocation distinct from stocks and bonds.

Market Realist Tactical allocation to high yield bonds adds significant value

The high yield bond (HYG) market offers attractive investment opportunities to investors seeking higher risk-adjusted returns. On the risk assessment scale, high yield bonds sit between investment-grade bonds and equities. High yield bonds are issued not only by large companies—smaller companies are also very active in the market.

High yield bonds are one of the most important investment tools for diversifying a portfolio, protecting against downside risk. They also help lower portfolio volatility and enhance returns. They have a very low correlation to investment grade bonds while exhibiting a high correlation to equities. Moreover, high yield bonds’ (JNK) (BKLN) lower sensitivity to rising interest rates than Treasuries and investment-grade bonds help protect the portfolio. In fact, when interest rates rise, high yield bonds have provided higher returns in the past. As the Fed is expected to increase rates aggressively this year, this is a potential concern.

The high yield (SJNK) (HYS) market has experienced a boom in recent years due to a slowing global economy and lower interest rates. Empirical evidence suggests that tactical allocation to high yield bonds adds significant value to a portfolio in terms of higher returns, lower volatility, and diversification benefits.

Exploring global opportunities

The rapid growth in the global high yield market provides additional opportunities for investors to take part in growth stories in other markets and benefit from favorable risk-return characteristics. The global high yield market may enable investors to better control risk through adequate diversification across industries and geographic sectors.

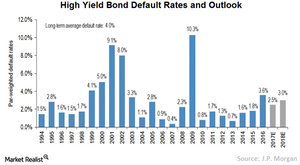

Default rates set to decline

Historically, the average high yield default rate is 5.4%. Moody’s expects the default rate to fall from the current 5.8% to 3.7% by the end of 2017, mainly aided by the improving economy. JPMorgan Chase, on the other hand, expects the default rate to dip further down to 2.5% in 2017. JPMorgan Chase’s analysis revealed that 84% of defaults in 2016 were from commodity-driven companies, while only a small percentage of companies in non-commodity sectors defaulted. The improving economy will certainly help high yield issuers service debt in a more effective manner. The above characteristics make a case for exploring high yield bonds’ superior risk-adjusted returns while seeking to diversify your portfolio.