How High-Yield Bonds Can Help Reduce Risk

AB A Place at the Asset-Allocation Table For investors seeking to control volatility in their equity portfolios while still maintaining return potential, high-yield bonds could represent an effective solution. A typical approach to moderating equity volatility is to reallocate assets to the greater stability of investment-grade bonds, or even cash. But this can exact a […]

Apr. 10 2017, Updated 2:36 p.m. ET

AB

A Place at the Asset-Allocation Table

For investors seeking to control volatility in their equity portfolios while still maintaining return potential, high-yield bonds could represent an effective solution.

A typical approach to moderating equity volatility is to reallocate assets to the greater stability of investment-grade bonds, or even cash. But this can exact a heavy cost in sacrificed return potential. High-yield bonds, on the other hand, can help investors reduce risk without sacrificing much return.

Doesn’t this make the case that high yield bonds deserve their own place at the table in portfolio discussions? Investors might want to consider taking a different perspective on asset allocation: instead of asking how much bond exposure should be allocated to high yield, perhaps they should ask how much equity exposure should be allocated to high yield.

Historically, answering that question with a significant allocation to high yield bonds—rebalanced quarterly—would have been a highly productive decision. Investors would have been able to substantially reduce overall portfolio volatility in exchange for only a minimal reduction—if any—in annualized returns.

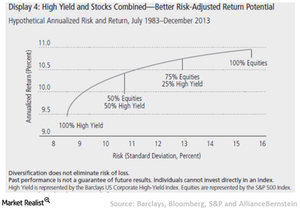

As mentioned earlier, from July 1983 through December 2013, the S&P 500 Index produced a 10.9% annualized return, with annualized risk of 15.2%. A portfolio mix of 75% equities and 25% high yield, on the other hand, would have lowered annualized risk to 12.8%, with nearly the same annualized return (Display 4). And that’s with a sizable allocation to a high-yield asset class that returned slightly less than equities over this time period. How is this result possible?

Market Realist

High yield bonds are less volatile than equities

As discussed in the previous section, high yield bonds (IHY) (HYG) are a perfect tool to offset the high volatility of stocks while enhancing the overall return potential of a portfolio or limiting the downside. This is due to the fact that high yield bonds are less volatile than stocks.

Bank of America Merrill Lynch data shows that the standard deviation of high yield bonds was 8.3 between January 1993 and September 2016, compared with 14.5 for large-cap stocks and 18.9 for small-cap stocks. Moreover, despite the higher returns provided by equities, the average decline for stocks between 1998 and 2015 was 11.8%, compared with 6.3% for high yield bonds.

Additional data reinforces this point. An Investment & Pensions Europe showed that high yield bonds (JNK) (SJNK) had higher risk-adjusted returns than stocks. Over the last 25 years, the annualized return per unit of risk from high yield bonds was 1.0, compared with 0.6 from large-cap stocks and 0.5 from small-cap stocks. On the other hand, Bank of America Merrill Lynch data revealed that although stocks generated higher returns, their higher volatility resulted in a Sharpe ratio of 0.11, lower than high yield bonds’ ratio of 0.18. High yield bonds (HYS) higher Sharpe ratio indicates more attractive risk-adjusted returns. With advantages such as higher returns and lower volatility offered, high yield bonds certainly deserve a prominent position in a portfolio.