Dupixent Expected to Be a Solid Addition to Regeneron’s Portfolio

On March 28, 2017, the FDA approved Regeneron (REGN) and Sanofi’s (SNY) Dupixent for the treatment of patients with moderate-to-severe eczema or atopic dermatitis (or AD).

Apr. 27 2017, Updated 9:08 a.m. ET

Dupixent approval

On March 28, 2017, the FDA approved Regeneron (REGN) and Sanofi’s (SNY) Dupixent for the treatment of patients with moderate-to-severe eczema or atopic dermatitis (or AD).

This approval should enable Regeneron to have a diversified revenue base like its peers Amgen (AMGN) and Gilead Sciences (GILD).

Sanofi’s Genzyme Specialty Care business has focused its attention on promoting the drug to patients with significant unmet demand as well as to physicians with experience prescribing biologic therapies.

Both Regeneron and Sanofi plan to extensively market Dupixent to dermatologists, allergists, immunologists, and up to 7,000 doctors in the United States. To learn more about Dupixent, read Dupixent May Help Diversify Regeneron’s Revenues in 2017.

Payer access

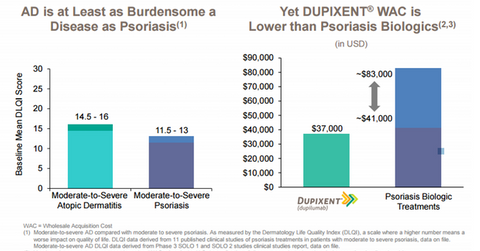

Regneron is confident that Dupixent won’t face significant access constraints, as it has based its pricing on the clinical and economic value of the drug. Despite the significant burden brought on by AD, Dupixent is priced much lower than biologic therapies for psoriasis.

The current wholesale acquisition cost for Dupixent is fixed at $37,000 per patient per year. Regeneron and Sanofi expect healthcare payers to pay a net price of up to $30,000 per patient per year for the drug, which will be inclusive of rebates, discounts, co-pay assistance, and patient system programs.

Dupixent was launched in the United States in early April 2017. If Regeneron and Sanofi manage to further expand the drug’s label beyond AD to other indications such as asthma and nasal polyposis, it could have a favorable impact on their share prices as well as the price of the VanEck Vectors Pharmaceutical ETF (PPH). Sanofi makes up ~5.6% of PPH’s total portfolio holdings.