What You Need to Know about the US Hotel Industry Performance

The hotel industry is largely driven by the growth of the general economy, which instills spending confidence in both businesses and households.

Mar. 6 2017, Published 11:49 a.m. ET

Hotel indicators

The hotel industry is largely driven by the growth of the general economy, which instills spending confidence in both businesses and households. Leisure travelers make up ~60% of total hotel room sales, whereas business travelers account for 40%.

Leisure travel is largely driven by disposable income availability and consumer confidence. Growth in business travel depends on general economic activity, and in times of trouble, companies look to cut down on business travel costs by selectively authorizing travel or by reducing expenditure per trip. The US hotel sector is highly fragmented, with the largest 50 hotel companies accounting for just over 45% of market share.

US hotel revenue

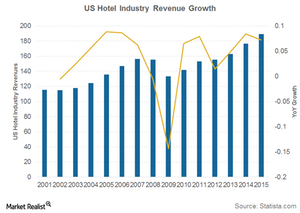

Since falling 14% in 2009, the US hotel industry has recovered nicely. It’s recorded a 6% five-year compound annual growth rate since 2010. In 2015, its revenue rose 7% to $189.5 billion. The 2016 data has yet to come in.

Series outlook

Investors can use the hotel indicators discussed in this series to determine where the hotel industry is headed. We’ll start the series by analyzing key hotel indicators such as occupancy levels and average daily rate, which are in turn driven by the demand for and supply of rooms. We’ll also discuss consumer spending and confidence, airline ticket prices, and the strengthening US dollar, which also affect demand and supply in the hotel sector.

Investors can gain exposure to hotel stocks by investing in the Consumer Discretionary Select Sector SPDR ETF (XLY), which holds 0.63% in Marriott International (MAR) and 0.38% in Wyndham Worldwide (WYN). Other major hotel stocks include Hilton Worldwide (HLT) and Hyatt Hotels (H).