The Real Estate Reaction: Gauging the Impact of the Fed’s Rate Hikes

The rising interest rate is expected to boost the economy in the long run, but it could severely impact sectors like real estate.

Nov. 20 2020, Updated 3:54 p.m. ET

What it means for the real estate sector

The US Federal Reserve increased the federal funds interest rate on March 15, 2017, and the decision was in line with market expectations. The rise is expected to boost the economy in the long run, though it could severely impact sectors like real estate. Real estate recorded a slight gain after the Fed’s announcement on March 15, 2017, and one possible reason could be the dovish tone that Fed Chair Janet Yellen took toward future rate hikes in 2017.

Real estate performance in 2016

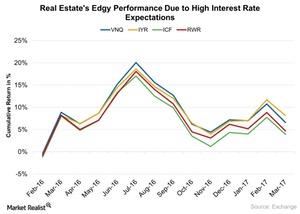

The real estate sector has so far benefitted tremendously from the low interest rate environment since the 2008 mortgage crisis. Since US markets started showing improvements in overall economic activity, the expectation of the interest rate hike began to build in the second half of 2016. Now, since July 2016, we’ve seen the real estate sector (VNQ) (IYR) (ICF) (RWR) fall more than 10%.

Expectations for 2017

The interest rates on mortgages, banks loans, and credit card loans are now expected to rise in step with hikes in 2017. Notably, economist Jonathan Smoke shared the following view on the Fed’s rate hike on March 15: “Today’s Fed announcement is going to have the greatest impact on first-time home buyers as they consider their monthly payment budgets. Rates will likely stay the same until about March so buyers considering a purchase in 2017 may want to consider getting into the market now.”

Rising inflation is expected to drive the monetary policy decisions to come in 2017, and the expectation of two more hikes in the latter half of 2017 will likely keep impacting the real estate sector negatively. The market consensus expects the federal funds rate to finish 2017 in the 1.5%–1.75% range. But one hope surrounding the prospect of a higher interest rate environment is that rising inflation will increase the demand for real estate assets as protection against inflation.

A few real estate investment trusts to watch include Simon Property Group (SPG), Public Storage (PSA), Equinix REIT (EQIX), and Prologis (PLD).

For more information on the economic outlook for 2017, check out Market Realist’s Global Economy in 2016 and Expectations for 2017.