Performance of GlaxoSmithKline’s Vaccines Business in 2016

GSK’s Vaccines business reported growth of 14% to ~4.6 billion pounds in 2016.

Mar. 30 2017, Updated 7:36 a.m. ET

Vaccines business

GlaxoSmithKline (GSK) is focused on strengthening its Vaccines business. It acquired the Meningitis and Other Vaccines business from Novartis (NVS). The growth of the Vaccines segment is driven by increased sales of Rotarix, Boostrix, hepatitis vaccines, the newly acquired meningitis vaccines Menveo and Bexsero, and key vaccines such as Infanrix and Pediarixm.

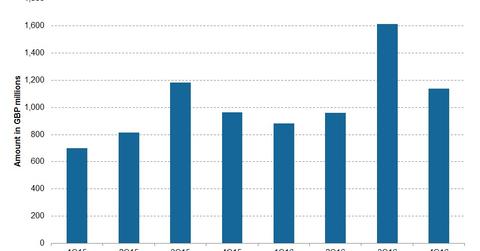

The above chart shows the revenues for the Vaccines Segment over the last eight quarters.

Performance of the Vaccines business

GSK’s Vaccines business reported growth of 14% to ~4.6 billion pounds in 2016. The Novartis acquisition has improved sales for the Vaccines business, mainly driven by the sales of meningitis vaccines Bexsero in Europe and Menveo in the US and Europe.

The US markets reported 13% growth in revenues to ~1.6 million pounds during 2016. This growth was driven by strong sales of Bexsero in the US markets, partially offset by lower sales of Fluarix.

The European markets reported 18% growth to ~1.4 billion pounds during 2016. This growth was driven by Bexsero, Synflorix, Boostrix, and hepatitis A vaccine sales, which were partially offset by lower sales of Infanrix and Pediarix due to competition.

The international market sales increased 10% on a reported basis to ~1.6 billion pounds. This growth was driven by Bexsero, Boostrix, Cervarix, Infanrix and Pediarix, and hepatitis vaccines.

The major competitor for GSK’s meningitis products like Bexsero is Pfizer’s (PFE) Trumenba. Sanofi Pasteur (SNY) also has a meningitis vaccine—Menactra.

For broad-based industry exposure, investors can consider the PowerShares International Dividend Achievers ETF (PID), which holds 2.4% of its total assets in GlaxoSmithKline, 1.5% in Sanofi (SNY), 1.1% in Novartis (NVS), and 1.1% in Teva Pharmaceuticals (TEVA).