Why Entresto Could Become Key Growth Driver for Novartis in 2017

Novartis (NVS) expects modest prescription growth for its heart failure drug, Entresto, in 1Q17.

Mar. 30 2017, Updated 7:36 a.m. ET

Entresto’s growth trends

Novartis (NVS) expects modest prescription growth for its heart failure drug, Entresto, in 1Q17. This expected growth is due in part to discussions related to rebates and access, as the company has decided to include the drug as part of the Medicare Part D program. The company is confident that prescriptions for Entresto could rise by the end of 2017.

Approved by the U.S. Food and Drug Administration (or FDA) to treat heart failure on July 7, 2015, Entresto has managed to earn $170 million in revenues in 2016. The revenue performance in 2H16 for the drug was almost two times greater than that in 1H16. If Novartis manages to improve market access for Entresto in 2017, it could have a positive impact on the company’s stock as well as the First Trust Value Line Dividend Index Fund (FVD). Novartis makes up about 0.51% of FVD’s total portfolio holdings.

Improving market access

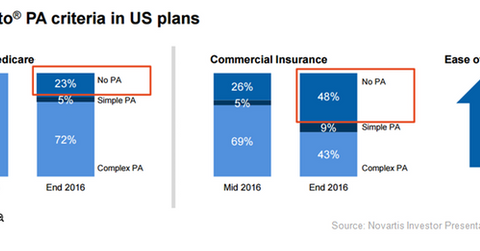

To improve market access for Entresto in US markets in 2017, Novartis has been aggressively trying to reduce the prior authorization constraints required to secure reimbursement for the drug. In mid-2016, 100% of patients had to secure prior authorization before getting access to Entresto. By the end of 2016, the company had managed to free 23% of the Medicare patients from the prior authorization requirement for getting access to Entresto.

Novartis has also managed to improve market access for patients covered by commercial payers. In mid-2016, physicians could prescribe Entresto to only 26% of the commercially covered patient population. This number increased to 48% at the end of 2016. Ease of access to Entresto is expected to become a key growth driver for the drug in 2017, enabling it to pose tough competition to other heart failure therapies such as Amgen’s (AMGN) Corlanor, Merck’s (MRK) Cozaar, and Pfizer’s (PFE) Inspra.

In the next article, we’ll discuss demand trends for Entresto in the Medicare segment in greater detail.