Could Brexit and French Elections Move Precious Metals?

Overall sentiment in precious metals seems to be optimistic as global concerns keep piling up. There was unrest on Monday following the failure of the AHCA.

Mar. 31 2017, Updated 2:51 a.m. ET

Spur of economic events

The overall sentiment in precious metals seems to be optimistic as global concerns keep piling up. There was unrest on Monday, March 27, 2017, following the failure of the AHCA (American Healthcare Act) (H.R. 1628) to go to a vote on the floor of the House of Representatives on Friday, March 24. The AHCA was a bill to overhaul the Patient Protection and Affordable Care Act, commonly known as Obamacare. Failure of the bill to gain sufficient support gave gold (GLD) (SIVR) a kick in the pants.

The upcoming French election is causing uncertainty in Europe, which once again helps precious metals shine. In the United Kingdom, Prime Minister Theresa May filed formal Brexit papers on Wednesday, March 29.

All these economic events play a substantial role in moving gold. Gold futures for April expiration saw the day’s high of $1,255.90 per ounce on Wednesday, March 29. In spite of that, gold futures ended the day negative, falling 0.15%. Silver ended the day flat, whereas platinum and palladium fell 0.50% and 0.30%, respectively.

Gold and volatility

The call implied volatility in gold rose to almost 13.5% on Monday, March 27, 2017, as the markets were digesting the disappointment over the failed AHCA. After that, volatility subsided.

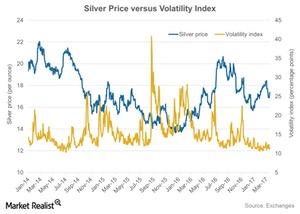

The above graph shows the performance of silver and how it’s synchronized to the overall market volatility. Market volatility is depicted by the CBOE Volatilty Index (or VIX).

The US dollar rose significantly on Wednesday due to haven bids following the above global concerns. To track the performance of gold and the dollar, be sure to read How Have US Dollar Losses Played on Gold?

The changes in precious metals went smoothly for mining companies and miners such as Franco-Nevada (FNV), Alacer Gold (ASR), Royal Gold (RGLD), and Sibanye Gold (SBGL). They rose 1.1%, 1.1%, 1.4%, and 2.0%, respectively, on Wednesday. These four miners together contribute about 12.5% to the changes in the VanEck Vectors Gold Miners ETF (GDX).