Behind the Airlines’ Increasing Labor Costs

Delta Air Lines (DAL), Southwest Airlines (LUV), United Continental (UAL), and American Airlines (AAL) renegotiated contracts with their pilots and other contract workers toward the end of 3Q16.

Mar. 31 2017, Updated 10:36 a.m. ET

Labor cost

When crude oil prices were at their peak at $100 per barrel, labor costs were the second-biggest cost for airlines. Thanks to the substantial decline in fuel costs, labor now forms the largest expense for any airline.

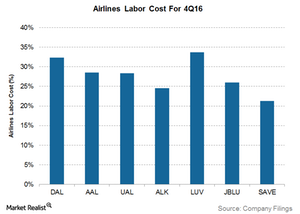

In 4Q16, Southwest Airlines (LUV) had the highest labor costs, comprising 34% of its revenues. Delta Air Lines (DAL) finished in a close second place, with labor costs forming 32% of its revenues. These high labor costs contributed to these two airlines posting lower margins than their peers.

Although American Airlines (AAL) and United Continental (UAL) have lower labor costs than Southwest Airlines and Delta Air Lines, higher income tax provisioning led to a significant decline in margins for 2016. In 4Q16, labor costs formed 29% of AAL’s revenues and 28% of UAL’s revenues.

In 4Q16, JetBlue Airways’s (JBLU) labor costs comprised 26% of its revenues. Alaska Air Group’s (ALK) labor costs formed 25% of its revenues, and Spirit Airlines’s labor costs comprised 21% of its revenues.

Other costs

Spirit Airlines’s (SAVE) labor costs are lower than those borne by Alaska Air Group. However, SAVE still has lower margins than ALK because its aircraft rent expenses, which form just 2% of Alaska Air Group’s revenues, comprise ~9% of SAVE’s revenues. For all other carriers discussed in this series, this cost comprises 1%–2% of their revenues.

Aircraft maintenance constitutes 4%–5% of revenues for all airlines except JetBlue, where it comprises 8% of revenues. Landing fees and other rents formed 6% of revenues for all airlines except Delta Air Lines and American Airlines, where these expenses comprise just 4% of revenues.

Labor costs increased

Most airlines, including Delta Air Lines (DAL), Southwest Airlines (LUV), United Continental (UAL), and American Airlines (AAL) renegotiated the contracts with their pilots and other contract workers toward the end of 3Q16. According to these contracts, pilots would receive a pay raise over the next two years followed by additional pay increases for two to three years thereafter.

These pay increases should mean peaceful labor relations for these airlines for the next few years. This is good news for both parties, especially for Southwest Airlines, which had struggled to reach an agreement with its pilots for the past four years.

However, this means increased labor costs, which became apparent in 4Q16. The full impact should be seen in 2017. Another factor pressuring airlines’ profitability is leverage, which we’ll analyze in our next article.

Investors can gain exposure to the industry by investing in the SPDR S&P Transportation ETF (XTN), which invests ~15% of its holdings in airlines.