Will Kinder Morgan Stock Continue to Surge in 2017?

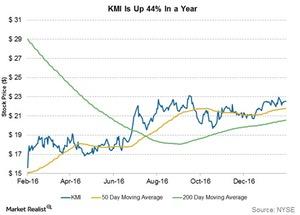

Kinder Morgan stock has risen 44% in the past year, as compared to Enterprise Products Partners’ 32% rise and ONEOK’s 162% rise.

Dec. 4 2020, Updated 10:53 a.m. ET

KMI’s stock performance

Kinder Morgan (KMI) stock has risen 44% in the past year. By comparison, Enterprise Products Partners (EPD) stock has risen 32%, while ONEOK (OKE) has risen 162% over the same timeframe.

Notably, the Alerian MLP Index (AMZ) has risen 46% in the past year. KMI’s rise was in-line with the sector over the last 12 months. The SPDR S&P 500 ETF (SPY) (SPX-INDEX) has risen 23% during the same period.

The above graph shows KMI’s stock price and its 50-day and 200-day moving averages.

KMI trades above 50-day moving average

Kinder Morgan is currently trading 4% above its 50-day moving average and 10% above its 200-day moving average. This indicates a possible upside for the stock in the near future. KMI crossed above its 200-day moving average in July 2016 and is trading above that average since then.

Key projects move forward

In the company’s 4Q16 earnings release, Richard D. Kinder, KMI’s executive chairman, stated: “We are pleased to have reached significant milestones on two of our largest growth projects. We received approval from the Canadian federal government and the province of British Columbia to proceed with our Trans Mountain expansion project, and we also began construction on our Elba Island Liquefaction project. These are signature energy infrastructure assets for North America.”

Learn more about the company’s Trans-Mountain project, which recently got approval from British Columbia province too, in Investor Update: Kinder Morgan Pipeline Project to Move Forward.

In this series

In this series, we’ll take a look at the fundamental strengths of Kinder Morgan. We’ll analyze KMI’s price targets, the performance of its various segments, its leverage, its distributable cash flows, its capital expenditures, and key growth drivers. We’ll also analyze its current valuation relative to peers.

Continue to the next part for a closer look at Kinder Morgan’s assets.