Why So Many Analysts Are Rating Marathon Petroleum as a ‘Buy’

Exactly 17 out of the 19 analysts covering Marathon Petroleum (MPC) have rated it a “buy” in February 2017.

Nov. 20 2020, Updated 12:57 p.m. ET

Marathon Petroleum’s recommendations

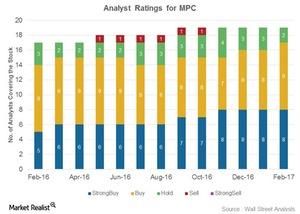

The analyst rating chart below shows that 17 out of the 19 analysts covering Marathon Petroleum (MPC) have rated it a “buy” in February 2017. Another two analysts have rated MPC as a “hold.” MPC’s mean price target of $63 per share implies a ~25% gain from the current level.

Changes in analyst ratings

Compared to January 2017, the ratings have improved with more “buy” ratings in February 2017. Similarly, compared to February 2016, MPC’s ratings have strengthened with more “buy” ratings and fewer “hold” ratings.

After its earnings release, UBS has upgraded MPC’s rating from “neutral” to “buy.” The firm also raised MPC’s target price from $60 to $63, while Scotia Howard Weil raised the stock’s target price from $39 to $44. By contrast, Barclays has cut MPC’s target price from $68 to $62 and now has an “overweight” rating on the stock.

Peer ratings

MPC peers Tesoro (TSO), Valero Energy (VLO), and Phillips 66 (PSX) have been rated as “buy” by 72%, 62%, and 21% of analysts, respectively. Smaller players Delek US Holdings (DK), Alon USA Energy (ALJ), and Western Refining (WNR) have been rated as “buy” by 36%, 25%, and 25% of analysts, respectively.

Notably, for exposure to small-cap stocks, you might consider the iShares Russell 2000 Value ETF (IWN). IWN has ~6% exposure to energy sector stocks, including DK, WNR, and ALJ.

MPC focusing on unlocking value

Marathon Petroleum (MPC) aims to raise value for shareholders by dropping down assets to MPLX (MPLX), its midstream master limited partnership. MPC is also planning to exchange its economic interest in GP and IDRs for new MPLX LP units.

To know more about what IDRs are, please refer to Market Realist’s “IDRs: How Do They Impact MLPs?” MPC also plans to separate Speedway or marketing segment. For more on the entire plan, please refer to Market Realist’s “Marathon Petroleum Rose 5% after Unveiling Its Strategic Plan.” Notably, MPC’s strategic plan came right after Elliott Management’s open letter to MPC.

In its 4Q16 earnings press release, Gary R. Heminger, MPC’s Chairman, President, and Chief Executive Officer, stated: “Moving into 2017, we are executing our strategic plan to unlock the tremendous value in our best-in-class midstream platform for the benefit of all investors. We are well-positioned across the business to take advantage of strengthening commodity prices, recovering refinery spreads and robust demand for our products.”

We might safely guess, based on the information available, that the majority of analysts have rated MPC as a “buy” given the company’s strategic plan.