What Are Analysts Recommending for Chemours ahead of 4Q16?

As of February 9, 2017, eight brokerage firms are actively tracking Chemours (CC) stock. About 25.0% of them have recommended a “buy” for the stock.

Feb. 10 2017, Updated 1:05 p.m. ET

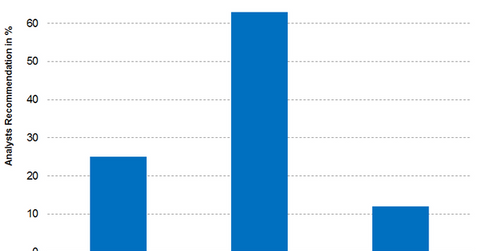

Analyst recommendations for Chemours

As of February 9, 2017, eight brokerage firms are actively tracking Chemours (CC) stock. About 25.0% of those analysts have recommended a “buy” for the stock, while 63.0% of them have recommended a “hold.” About 12.0% have recommended a “sell.”

The analyst consensus for Chemours indicates a 12-month target price of $22.90. That implies a return potential of -17.1% based on its closing price of $27.59 on February 9, 2017. The target price was $17.90 in November 2016. A higher target price was driven primarily by continuing improvement in the price of titanium dioxide, which is expected to benefit Chemours.

Recommendations and targets

Below are some recommended target prices for Chemours from some well known brokerage firms:

- On January 17, 2017, Susquehanna rated Chemours a “neutral” with a target price of $26. That implies a 12-month return of -5.8% based on the closing price of $27.59 on February 9, 2017.

- On December 12, 2016, Goldman Sachs (GS) lowered the target price for Chemours to $25. That implies a 12-month return of -9.4% based on the closing price of $27.59 on February 9, 2017.

- On November 16, 2016, Jefferies rated Chemours a “hold” with a target price of $25. That implies a 12-month return of -9.4% based on the closing price of $27.59 on February 9, 2017.

You can indirectly hold Chemours by investing in the PowerShares DWA Basic Materials Momentum ETF (PYZ). PYZ has invested 4.5% of its holdings in Chemours as of February 9, 2017. The fund’s top holdings include Cliffs Natural Resources (CLF) and Avery Dennison (AVY), with weights of 4.4% and 3.8%, respectively.