PBF Energy’s 4Q16 Results: Earnings Take a Nosedive

PBF Energy (PBF) released its 4Q16 results on February 16, 2017. The earnings results weren’t very encouraging for this petroleum refiner.

Feb. 17 2017, Published 9:49 a.m. ET

4Q16 estimated and actual performance

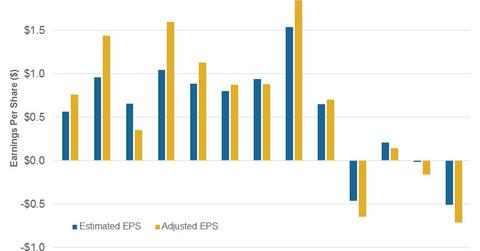

PBF Energy (PBF) released its 4Q16 results on February 16, 2017. The earnings results weren’t very encouraging for this petroleum refiner. Let’s see how the figures compare to Wall Street analysts’ estimates.

Revenues surpassed estimates by 14.0%, but adjusted EPS (earnings per share) was -$0.71 compared to the estimated -$0.51. In 4Q15, adjusted EPS was $0.70.

PBF Energy’s 4Q16 earnings review

Now let’s take a closer look at PBF’s 4Q16 results. Its adjusted operating income fell to -$61.0 million compared to $168.0 million in 4Q15. Operating income was adjusted for special items such as after-tax inventory gains due to lower costs or market valuations. Adjusted net income was -$74.9 million compared to $71.0 million in 4Q15.

The fall in earnings was due to subdued performance in the Refining segment, partially offset by better earnings for the Logistics segment. The refining margin contracted 34.0% compared to 4Q15, to $5.80 per barrel. We’ll take a closer look at those margins in the next part of this series.

By comparison, EPS in 4Q16 for Marathon Petroleum (MPC), Phillips 66 (PSX), and Valero Energy (VLO) fell 48.0%, 88.0%, and 55.0%, respectively, compared to 4Q15. Delek US Holdings (DK) and Alon USA Energy (ALJ) are also expected to post losses in 4Q16.

For exposure to small-cap stocks, you can consider the iShares Russell 2000 Value (IWN) (RUT-INDEX). IWN has a ~6.0% exposure to energy sector stocks, including DK and ALJ.

In the next few parts of this series, we’ll take a close look at PBF’s segmental performance, stock performance, implied volatility, and analyst ratings after its 4Q16 earnings release.