Novartis’s Valuation after the 4Q16 Results

On January 31, 2017, Novartis was trading at a forward PE multiple of ~15.2x. Based on its last-five-year multiple range, this is neither high nor low.

Feb. 3 2017, Updated 10:36 a.m. ET

Valuation multiples

We believe the forward PE (price-to-earnings) and EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiples are the two best valuation multiples to use when valuing Novartis (NVS) and other large pharmaceutical companies, given the relatively stable and visible nature of their earnings.

Remember, the PE multiple is widely available and represents what one share can buy for an equity investor, whereas the EV-to-EBITDA multiple is capital structure neutral.

Forward PE

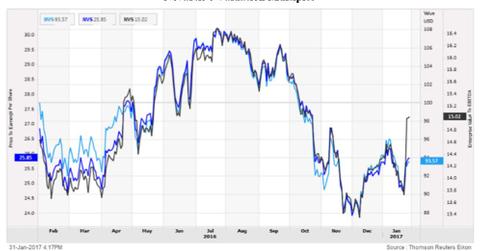

On January 31, 2017, the company was trading at a forward PE multiple of ~15.2x. Based on its last-five-year multiple range, Novartis’s current valuation is neither high nor low. Novartis’s PE multiple has ranged from ~9x to ~20x.

Novartis’s valuation multiple has also followed the industry’s overall trend for the past five years. Whether the healthcare sector’s forward PE multiple rises or falls, Novartis will definitely be affected.

The industry currently trades at a forward PE multiple of ~14.4x. Competitors Pfizer (PFE), AstraZeneca (AZN), and GlaxoSmithKline (GSK) have forward PE multiples of 12.3x, 14.3x, and 14.5x, respectively.

EV-to-EBITDA

On a capital structure neutral basis, Novartis currently trades at ~14.5x, which is much higher than the industry’s average of ~9.6x. Competitors Pfizer (PFE), AstraZeneca (AZN), and GlaxoSmithKline (GSK) have forward EV-to-EBITDA multiples of 9.2x, 11.5x, and 9.6x, respectively.

The above multiples represent an improvement in estimates and valuations for Novartis, which is a positive sign for the investors. To divest risk, investors can consider ETFs like the First Trust Value Line Dividend ETF (FVD), which has ~0.5% of its total assets in Novartis.