How Gilead’s Other Products Fared in 2016

The oncology portfolio includes the drug Zydelig, which is used in combination with rituximab for the treatment of chronic lymphocytic leukemia (or CLL).

Mar. 2 2017, Updated 7:37 a.m. ET

Gilead’s portfolio

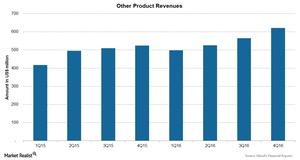

Apart from Gilead’s (GILD) HIV and liver disease portfolio, the company also has drugs for oncology, cardiovascular, inflammation, respiratory, and other therapeutic areas. Over 90% of revenues come from antiviral product sales from the HIV franchise and the liver disease franchise. Other products reported revenues of $1.6 billion for 2016 as compared to $1.4 million for 2015.

Oncology portfolio

The oncology portfolio includes the drug Zydelig, which is used in combination with rituximab for the treatment of chronic lymphocytic leukemia (or CLL). It’s also used in the treatment of relapsed follicular B-cell non-Hodgkin lymphoma and small lymphocytic lymphoma for patients who have undergone at least two prior treatments. Zydelig reported revenues of $168 million in 2016.

Cardiovascular portfolio

The cardiovascular portfolio consists of three drugs. Letairis is used in the treatment of pulmonary arterial hypertension. Lexiscan injections are used as a pharmacologic stress agent indicated for radionuclide myocardial perfusion imaging. Ranexa is used for the treatment of patients with chronic angina.

During 2016, Letairis and Ranexa reported revenues of $819 million and $700 million, respectively.

Inflammation and respiratory portfolio

The inflammation and respiratory portfolio includes two drugs: Cayston and Tamiflu. Cayston is used for improving respiratory symptoms in patients with cystic fibrosis and pseudomonas aeruginosa. Tamiflu is an influenza neuraminidase inhibitor used in the treatment of patients with influenza infection.

Others

AmBisome and Macugen are other drugs from Gilead. AmBisome reported revenues of $356 million during 2016 as compared to $350 million during 2015. AmBisome is used in empirical therapy where fungal infections are presumed in febrile and neutropenic patients.

Stribild competes with GlaxoSmithKline’s (GSK) Tivicay. Other drugs include Bristol-Myers Squibb’s (BMY) Evotaz, Johnson & Johnson’s (JNJ) Prezcobix, and Merck’s (MRK) Isentress.

To divest the risk, investors can consider ETFs like the iShares S&P Global Healthcare ETF (IXJ), which holds ~2.2% of its total assets in Gilead Sciences.