Hanesbrands Stock: Understanding Wall Street’s View

In this part of the series, we’ll look at Wall Street’s recommendation on Hanesbrands (HBI) and discuss Wall Street’s take on the company.

Feb. 8 2017, Updated 7:36 a.m. ET

Comparing Wall Street’s view on HBI with peers

In this part of the series, we’ll look at Wall Street’s recommendation on Hanesbrands (HBI) and discuss Wall Street’s take on the company.

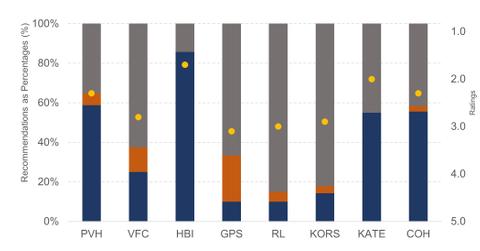

Wall Street has a positive to neutral view on the company and has rated its stock a 1.7 on a scale of “1: strong buy” to “5: sell.” The company has received one of the best ratings in the apparel sector. Peers PVH (PVH), VF Corp (VFC), Michael Kors (KORS), and Ralph Lauren (RL) have been rated 2.3, 2.8, 2.9, and 3, respectively.

A look at recommendations

Hanesbrands is covered by 14 Wall Street analysts. 86% of analysts recommend buying the stock while 14% recommend holding the stock. There are no “sell” recommendations on the stock yet. However, rating revisions might follow in a couple of days.

HBI has received more “buy” recommendations than other branded apparel peers. PVH, VF Corp, and Ralph Lauren are rated a “buy” by 59%, 25%, and 10% of analysts, respectively.

A look at the target price

While HBI’s stock has recently taken a hit, Wall Street continues to be positive about the company. HBI has been assigned an average price target of $27.54. This target indicates a gain potential of about 45% over the next 12 months.

The company has better gain potential than PVH, VF Corp, and Ralph Lauren—which are expected to see a price rise of about 29%, 14%, and 8% over the next 12 months.

Investors wanting to get exposure to HBI can consider pooled investment vehicles like the Guggenheim S&P 500 Equal Weight Consumer Discretionary ETF (RCD), which invests 1.09% of its portfolio in HBI.