Ares Capital Valuations at a Premium on Relative Outperformance

Ares Capital stock has risen ~11.7% over the past six months. The company saw a strong performance in 4Q16 on higher deployment, stable yields, and expense management.

Mar. 1 2017, Updated 7:35 a.m. ET

Dividends

Ares Capital (ARCC) stock has risen ~11.7% over the past six months. The company saw a strong performance in 4Q16 on higher deployment, stable yields, and expense management. The company paid a dividend of $0.38 per share in 4Q16, in line with the dividend it paid the year before.

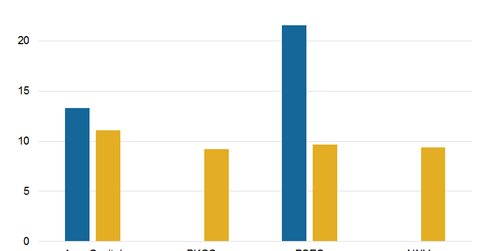

With a dividend yield of 8.6%, completion of its acquisition of American Capital, and stable yields, the company may provide better returns to its shareholders in 2017. Here’s how some of its peers compare in terms of dividends:

Together, these companies form 6.3% of the PowerShares Global Listed Private Equity ETF (PSP). During 4Q16, Ares Capital’s net investment income fell to $138 million on a year-over-year basis due to its higher exits over the past year. The company saw higher net realized gains of $32 million and a GAAP (generally accepted accounting principles) net income of $75 million. Ares Capital’s takeover of American Capital will result in diversification toward retail loans.

High valuations

Currently, Ares Capital is trading at 11.1x on a one-year forward earnings basis. Its peers are trading at 9.4x. The premium has widened in recent quarters on relative outperformance. The company’s yields have fallen marginally in recent quarters due to shifting toward the Senior Direct Loan Program. However, it’s consolidating through inorganic expansion, new programs, and the raising of its credit limits for future expansion.

Middle market lenders could see revivals in their yields, as the Federal Reserve is likely gearing up for rate hikes in 2017. This could propel yields in the market and could result in lending at relatively high yields.

In the next and final part of this series, we’ll study Ares Capital’s analyst ratings in February 2017.